Cryptocurrency has taken the world by storm, with Bitcoin leading the pack as the most well-known and valuable digital currency. However, despite its popularity, many people still struggle to understand what Bitcoin is and how it works.

This article will demystify Bitcoin by exploring its history, technology, and practical applications. We will also discuss the potential challenges and opportunities that come with using Bitcoin and other cryptocurrencies.

Introduction

A brief history of Bitcoin

In 2008, an individual or group using the pseudonym Satoshi Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” outlining the concept of a decentralized digital currency. In 2009, Bitcoin was launched as the first cryptocurrency, and it has since revolutionized how people conduct financial transactions.

Significance of Bitcoin in Today’s World

Today, Bitcoin is more than just a digital currency. It represents a new era of decentralized finance, where individuals can transact without relying on traditional financial institutions. With its borderless nature and the potential for lower fees, Bitcoin is increasingly being adopted by businesses and individuals worldwide.

Understanding the Basics

What is cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that relies on cryptography to secure transactions and control the creation of new units. Unlike traditional currencies, cryptocurrencies are not issued or regulated by a central authority, making them immune to government interference or manipulation.

Blockchain technology explained

Blockchain is the underlying technology that powers Bitcoin and other cryptocurrencies. It is a distributed ledger that records transactions in a secure, transparent, and tamper-proof manner. Each new transaction is added as a block in a chain, ensuring the integrity and immutability of the data.

The decentralized nature of Bitcoin

Decentralization is a key feature of Bitcoin, as it operates on a peer-to-peer network without a central authority. This means that transactions are processed and verified by the users themselves, eliminating the need for intermediaries such as banks or payment processors.

Getting Started with Bitcoin

Setting up your digital wallet

To store and manage your Bitcoins, you need a digital wallet, which can be a software application, hardware device, or even a paper wallet. These wallets generate unique public and private keys allowing you to send and receive Bitcoins securely.

Buying your first Bitcoins

You can buy Bitcoins through various methods, such as cryptocurrency exchanges, peer-to-peer platforms, or Bitcoin ATMs. When purchasing, you’ll need to provide your wallet’s public key (also known as your wallet address) so the seller can send the Bitcoins to your wallet.

Understanding public and private keys

Public and private keys are essential components of your digital wallet. Your public key serves as your wallet address, allowing you to receive Bitcoins from others. Your private key, on the other hand, is like a password that allows you to access and spend your Bitcoins. It’s crucial to keep your private key secure and never share it with anyone.

Bitcoin Mining

The Role of Miners in the Bitcoin Network

Miners are essential participants in the Bitcoin network, as they validate transactions and secure the blockchain. By solving complex mathematical puzzles, miners compete to add new blocks to the chain, and they’re rewarded with newly created Bitcoins and transaction fees.

Proof-of-Work and mining rewards

Bitcoin mining is based on a consensus algorithm called Proof-of-Work (PoW). Miners have to prove they’ve expended computational power to solve a puzzle, and the first miner to solve it adds a new block to the blockchain. They receive newly minted Bitcoins and transaction fees from the block as a reward.

Energy consumption and environmental concerns

Bitcoin mining is energy-intensive, as it requires significant computational power to solve the PoW puzzles. This has led to concerns about the environmental impact of mining, with some critics arguing that electricity consumption is unsustainable. In response, some mining operations are moving towards renewable energy sources, and alternative consensus mechanisms, like Proof-of-Stake, are being explored.

Trading and Investing

Spot trading: buying and selling Bitcoin

Spot trading involves the direct exchange of Bitcoins for fiat currencies or other cryptocurrencies. This can be done through cryptocurrency exchanges, which act as a marketplace for buyers and sellers to trade at the current market price.

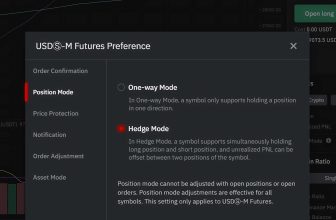

Leveraged trading: margin and futures

Leveraged trading allows traders to borrow funds to increase their exposure to Bitcoin price movements, amplifying potential profits or losses. Margin trading involves borrowing money from an exchange, while futures trading involves contracts that speculate on the future price of Bitcoin.

Long-term investing strategies

Long-term Bitcoin investors, often called “HODLers,” believe in the currency’s long-term potential and hold onto their Bitcoins regardless of short-term market fluctuations. Dollar-cost averaging, which involves buying a fixed amount of Bitcoin at regular intervals, is a popular long-term investment strategy that aims to reduce the impact of volatility.

Automated Trading and Bitcoin Trading Bots

The Role of trading bots in cryptocurrency markets

Trading bots are automated software programs that execute trades on behalf of users based on predefined strategies. These bots can analyze market data, execute trades, and manage risk, enabling users to trade more efficiently and potentially increase profits.

Popular Bitcoin trading bot platforms

Some popular Bitcoin trading bot platforms include Hinvest Ai, 3Commas, Cryptohopper, and HaasOnline. Each platform offers different features and customization options, so it’s essential to research and compares them to find the right fit for your needs.

Bitcoin Trading Bot Coin Bot

Strategies for using trading bots effectively

Users should clearly understand their risk tolerance, trading goals, and preferred strategies to use trading bots effectively. Some common strategies include arbitrage, market-making, and trend-following. Additionally, monitoring and adjusting your bot’s performance regularly is essential to ensure it remains effective in changing market conditions.

Security and Privacy

Safeguarding your digital assets

Securing your digital assets is crucial to prevent unauthorized access or theft.

Some best practices include using a hardware wallet, enabling two-factor authentication, and keeping your private keys offline. Regularly backing up your wallet and updating your software can also help protect your digital assets from potential threats.

Recognizing and avoiding common scams

Cryptocurrency scams are prevalent, and being vigilant is essential to avoid falling victim. Some common scams include phishing attacks, fake exchanges, and Ponzi schemes. To stay safe, always verify the authenticity of websites and services, be cautious with unsolicited offers, and research investments thoroughly.

Privacy features and limitations of Bitcoin

While Bitcoin transactions are pseudonymous, meaning that public addresses are not directly tied to users’ identities, they can still be traced and analyzed. Privacy-conscious users may explore alternative cryptocurrencies with enhanced privacy features like Monero or Zcash or use privacy-enhancing tools like CoinJoin for Bitcoin transactions.

Using Bitcoin for Transactions

The advantages of Bitcoin transactions

Bitcoin offers several advantages over traditional payment methods, such as lower transaction fees, faster processing times, and increased security. Additionally, its decentralized nature allows for borderless transactions, making it an attractive option for international payments and remittances.

Accepting Bitcoin as a merchant

Businesses can accept Bitcoin as payment by setting up a digital wallet and integrating a payment processing solution. Accepting Bitcoin can help merchants attract new customers, reduce payment processing fees, and eliminate chargeback risks associated with traditional payment methods.

Cross-border transactions and remittances

Bitcoin’s borderless nature makes it an ideal solution for cross-border transactions and remittances, allowing users to send funds quickly and inexpensively. This can be particularly beneficial for individuals in countries with limited access to traditional banking services or high remittance fees.

The Legal Landscape

Regulatory frameworks around the world

As Bitcoin’s popularity has grown, so has the attention of regulators. Countries have adopted various regulatory approaches, ranging from supportive frameworks to outright bans. It’s essential for Bitcoin users to stay informed about the regulatory environment in their jurisdiction and comply with any applicable laws.

Tax implications for Bitcoin users

In many countries, Bitcoin is subject to capital gains tax, meaning that users may be required to report and pay taxes on their Bitcoin transactions. The specific tax treatment varies by jurisdiction, so it’s essential to consult a tax professional or relevant government agency for guidance.

Legal Challenges and Controversies

Bitcoin has faced legal challenges and controversies, including its association with illicit activities and its potential for facilitating money laundering or tax evasion. While many argue that the technology itself is not inherently illegal, it’s important for users to use Bitcoin responsibly and abide by the law.

The Future of Bitcoin

The Role of Bitcoin in global finance

As Bitcoin continues to gain mainstream acceptance, its role in global finance is expected to grow. It has the potential to become a widely used store of value, a medium of exchange, and even a unit of account, potentially reshaping the global financial landscape.

Scalability and the Lightning Network

One of Bitcoin’s main challenges is its limited scalability, as the network can process a restricted number of transactions per second. The Lightning Network, a layer-2 solution, aims to address this issue by enabling faster, low-cost transactions while maintaining the security and decentralization of the underlying blockchain.

Potential Challenges and Threats to Bitcoin’s Growth

Bitcoin’s growth may face various challenges and threats, including regulatory crackdowns, competition from other cryptocurrencies or traditional financial systems, and technical vulnerabilities. Nevertheless, the technology and community behind Bitcoin continue to evolve and adapt, demonstrating its resilience and potential for long-term success.

Conclusion

FAQs

How can I safely store my Bitcoins?

Safely storing your Bitcoins involves using a secure wallet, such as a hardware wallet or a well-reputed software wallet, and keeping your private keys offline. Additionally, enabling two-factor authentication and regularly backing up your wallet can help protect your digital assets.

What are the risks associated with Bitcoin trading and investing?

Some risks associated with Bitcoin trading and investing include price volatility, potential loss of funds due to security breaches or user error, and regulatory risks. It’s essential to understand these risks, develop a clear investment strategy, and only invest what you can afford to lose.

Can I use Bitcoin for everyday transactions?

Yes, you can use Bitcoin for everyday transactions, as more businesses and merchants are starting to accept it as a form of payment. However, the speed and cost of transactions can vary depending on network congestion and fees.

Is Bitcoin legal in my country?

The legality of Bitcoin varies by country, with some governments embracing it, others imposing restrictions, and some banning it outright. To determine whether Bitcoin is legal in your country, consult local laws and regulations or seek advice from a legal professional.

What factors could influence the future value of Bitcoin?

Several factors could influence the future value of Bitcoin, including regulatory changes, technological advancements, market sentiment, competition from other cryptocurrencies, and macroeconomic factors. As with any investment, predicting the future value of Bitcoin is uncertain and involves risk.

Some Links: bitcoin.org, bitcoin.com