As a trader, it’s important to consider various investment strategies to ensure that you maximize your returns while minimizing risks. One such strategy is Dollar-Cost Averaging (DCA), which is an investment technique that is often used by traders to build a portfolio over time. In this article, we will explore what DCA is, how it works in trading, its benefits and drawbacks, and how it compares to other investment strategies.

Introduction

DCA is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This means that you will buy more shares when the price is low and fewer shares when the price is high, thereby averaging out the overall cost of your investment.

The goal of DCA is to reduce the impact of market volatility on your portfolio and ensure that you build a sizable position in the asset over time.

What Is Dollar-Cost Averaging (DCA)?

Definition of DCA

DCA is an investment technique that involves investing a fixed amount of money in a particular asset at regular intervals, regardless of its market value. By doing so, traders aim to reduce the impact of market volatility on their investments and gradually build their portfolios over time.

How DCA Works

DCA works by purchasing a fixed dollar amount of a particular asset at predetermined intervals, such as weekly, monthly, or quarterly. By investing the same amount regularly, traders buy more shares when the asset price is low and fewer shares when the price is high, effectively averaging out the cost of the investment over time.

DCA vs Lump-sum Investing

In contrast to DCA, lump-sum investing involves investing a large sum of money in a particular asset all at once. While this strategy can result in immediate gains if the asset price increases, it also exposes traders to more significant losses if the price drops.

Benefits and Drawbacks of DCA

One of the significant benefits of DCA is that it allows traders to take advantage of market fluctuations without having to time the market. Additionally, it can help reduce the overall risk of the investment by spreading it out over a more extended period. However, DCA may not be suitable for all traders as it can result in missed opportunities for immediate gains if the asset price rises significantly.

How to Implement DCA in Trading

Steps to Start a DCA Strategy

- Determine the amount you want to invest regularly.

- Set up a trading account that allows for automatic investing.

- Choose the asset you want to invest in.

- Select the frequency of investment.

- Set a budget and stick to it.

How Often to Invest

The frequency of investment in DCA can vary depending on the trader’s preferences and the asset being invested in. Weekly or monthly investments are common, but some traders may prefer to invest more frequently, such as daily.

Choosing the Right Asset for DCA

When choosing an asset for DCA, it’s important to consider its historical performance and potential for future growth. Traders should also choose an asset that aligns with their investment goals and risk tolerance.

Tips for Maximizing Returns with DCA

- Invest in assets with long-term growth potential.

- Keep track of your investment performance and adjust your strategy accordingly.

- Consider diversifying your investment portfolio.

DCA vs Other Investment Strategies

DCA vs Value Investing

Value investing involves identifying undervalued assets and investing in them with the expectation that they will increase in value over time. While DCA may result in a lower overall return, it is a less risky investment strategy as it spreads out the investment over time.

DCA vs Growth Investing

Growth investing involves investing in assets that have a high potential for growth. While this strategy can result in significant returns, it is also riskier than DCA as it involves investing a large sum of money all at once.

DCA vs Momentum Investing

Momentum investing involves investing in assets that have recently performed well, with the expectation that they will continue to do so in the short term. This strategy can result in significant gains but also exposes traders to more significant losses if the asset’s performance drops.

DCA in Different Markets

DCA in Stock Trading

DCA can be an effective investment strategy in the stock market, as it allows traders to invest in stocks without having to time the market. By investing a fixed amount of money regularly, traders can build a diverse portfolio of stocks and reduce the impact of market volatility.

DCA in Cryptocurrency Trading

DCA can also be applied to cryptocurrency trading, which is known for its high volatility. By investing a fixed amount of money in a particular cryptocurrency regularly, traders can reduce the overall risk of their investment and take advantage of market fluctuations over time.

DCA in Forex Trading

DCA can be an effective strategy in Forex trading, as it allows traders to take advantage of currency fluctuations without having to time the market. By investing a fixed amount of money regularly, traders can build a diverse portfolio of currency pairs and reduce the impact of market volatility.

DCA in Commodities Trading

DCA can also be applied to commodities trading, which is known for its cyclical nature. By regularly investing a fixed amount of money in a particular commodity, traders can reduce the overall risk of their investment and take advantage of market fluctuations over time.

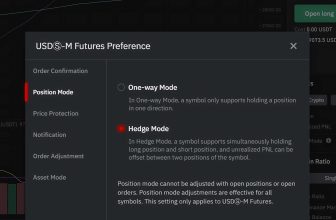

How DCA Works in Trading Bots

Explanation of How DCA is Implemented in Trading Bots

DCA can be implemented in trading bots by setting up automatic investments at regular intervals. Trading bots can also be programmed to adjust investment amounts based on market conditions to maximize returns.

Advantages and Disadvantages of Using DCA in Trading Bots

One of the significant advantages of using DCA in trading bots is that it allows traders to take advantage of market fluctuations without constantly monitoring the market. However, trading bots can also be prone to technical issues and require constant monitoring to ensure optimal performance.

Tips for Optimizing DCA in Trading Bots

- Set up automatic investments at regular intervals.

- Adjust investment amounts based on market conditions.

- Monitor the performance of the trading bot and make adjustments as necessary.

Benefits and Drawbacks of DCA in Trading Bots

One of the significant benefits of using DCA in trading bots is that it allows for automated investing, which can save time and effort. However, trading bots can also be prone to technical issues and require constant monitoring to ensure optimal performance.

How to Implement DCA in Trading Bots

Steps to Start a DCA Strategy in a Trading Bot

- Choose a trading bot that allows for automatic investing.

- Set up a budget and investment frequency.

- Choose the asset you want to invest in.

- Monitor the performance of the trading bot and adjust the investment strategy as necessary.

How Often to Invest in Trading Bots

The frequency of investment in trading bots can vary depending on the trader’s preferences and the asset being invested in. Weekly or monthly investments are common, but some traders may prefer to invest more frequently, such as daily.

Choosing the Right Asset for DCA in Trading Bots

When choosing an asset for DCA in trading bots, it’s important to consider its historical performance and potential for future growth. Traders should also choose an asset that aligns with their investment goals and risk tolerance.

Tips for Maximizing Returns with DCA in Trading Bots

- Choose a trading bot that has a proven track record of success.

- Monitor the performance of the trading bot and make adjustments as necessary.

- Consider diversifying your investment portfolio.

Real-World Examples of DCA

Successful DCA Strategies

Some successful DCA strategies include investing in blue-chip stocks, index funds, and mutual funds. These investments have historically shown consistent long-term growth and can help reduce the overall risk of the investment.

Analysis of Past DCA Performance

Studies have shown that DCA can be an effective investment strategy over the long term, particularly in volatile markets. However, the actual performance of DCA can vary depending on the asset being invested in and market conditions.

Lessons Learned from DCA

One of the key lessons learned from DCA is the importance of having a long-term investment strategy. By investing a fixed amount of money regularly, traders can build their portfolios over time and take advantage of market fluctuations without having to time the market.

Risk Management with DCA

Diversifying Your DCA Portfolio

One of the most effective ways to reduce the overall risk of a DCA portfolio is to diversify the investment across different assets. By investing in a range of assets, traders can spread out the risk and reduce the impact of market volatility.

Reducing Risks with DCA

DCA can be an effective risk management strategy by reducing the impact of market volatility on investment. By investing a fixed amount of money regularly, traders can avoid investing a large sum of money all at once and reduce the risk of significant losses.

Using Stop-Loss Orders with DCA

Stop-loss orders can be used in conjunction with DCA to reduce the overall risk of the investment. By setting a stop-loss order, traders can automatically sell their investment if the asset price drops below a certain level, limiting potential losses.

Criticism of DCA

Arguments Against DCA

One of the main arguments against DCA is that it can result in missed opportunities for immediate gains if the asset price rises significantly. Additionally, DCA may not be suitable for traders who prefer a more active investment strategy.

The Efficient Market Hypothesis and DCA

The Efficient Market Hypothesis (EMH) suggests that asset prices reflect all available information, making it difficult to outperform the market consistently. While DCA can be an effective investment strategy in certain market conditions, it may not consistently outperform the market over the long term.

Alternative Investment Strategies

Traders can use several alternative investment strategies, such as value investing and growth investing, instead of DCA. However, these strategies may be riskier and require more active monitoring of the market.

Conclusion

FAQs

Is DCA suitable for all traders?

DCA may be unsuitable for traders who prefer a more active investment strategy.

Can DCA be applied to all types of assets?

Yes, DCA can be applied to a range of assets, including stocks, cryptocurrency, Forex, and commodities.

What are the advantages of using DCA in trading bots?

The advantages of using DCA in trading bots include automated investing, time-saving, and reduced effort.

How often should traders invest in DCA?

The frequency of investment in DCA can vary depending on the trader’s preferences and the asset being invested in.

How can traders reduce the overall risk of their DCA portfolio?

Traders can reduce the overall risk of their DCA portfolio by diversifying their investments across different assets and using stop-loss orders.