In the world of finance and investment, the term “ROI” is commonly used to evaluate the profitability of an investment. ROI stands for “Return on Investment,” and it is a crucial metric for traders and investors to assess the performance and profitability of their trades or investment strategies. This article will delve into the meaning of ROI and explore its significance in both traditional trading and the realm of crypto trading bots.

Introduction

In today’s fast-paced financial markets, traders and investors constantly seek ways to maximize their profits. ROI is a fundamental metric to determine the effectiveness of trading strategies and investment decisions. Whether engaged in traditional trading or utilizing automated crypto trading bots, understanding ROI is essential for informed decision-making and optimizing returns.

What is ROI?

Return on Investment (ROI) is a performance measure used to evaluate the profitability of an investment relative to its cost. It indicates the percentage or ratio of the gain or loss generated by an investment compared to its initial investment amount. ROI is expressed as a percentage and provides insights into the efficiency and effectiveness of an investment strategy.

Calculating ROI in Trading

To calculate ROI in trading, one must consider the initial investment, any gains or losses incurred, and the duration of the investment period. The formula for calculating ROI is relatively straightforward.

3.1. Formula for ROI Calculation

ROI = (Net Profit / Cost of Investment) x 100

3.2. Example Calculation

Let’s assume an investor bought shares worth $10,000 and sold them a year later for $12,000. The net profit would be $12,000 – $10,000 = $2,000. Plugging these values into the ROI formula:

ROI = ($2,000 / $10,000) x 100 = 20%

This means the investor achieved a 20% ROI over the investment period.

ROI in Traditional Trading

4.1. Importance of ROI in Traditional Trading

ROI plays a vital role in traditional trading, where traders buy and sell various financial instruments such as stocks, bonds, commodities, or currencies. It helps traders assess the success of their trades and investment decisions, allowing them to compare different investment opportunities and strategies.

4.2. Factors Influencing ROI in Traditional Trading

Several factors impact ROI in traditional trading, including market conditions, economic indicators, risk management, and the trader’s knowledge and skills. By carefully analyzing these factors, traders can make informed decisions to optimize their ROI and minimize potential losses.

Grasping PNL (Profit and Loss)

As you delve into crypto trading with Hinvest.ai, two vital metrics will frequently cross your path: PNL (Profit and Loss) and ROI (Return on Investment). But what do these terms mean, and how do they relate to AI-powered crypto trading bots? Let’s find out.

Introduction to PNL (Profit and Loss)

PNL is a financial metric that measures the money earned or lost in an investment or a set of investments over a specific period. Simply put, it’s a tally of your profits minus your losses.

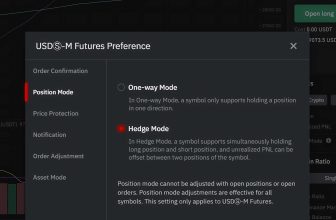

Differentiating between Unrealized PNL and Realized PNL

Understanding the difference between Unrealized PNL and Realized PNL is key to mastering your trading strategy.

Unrealized PNL

Unrealized PNL, also known as paper profit or loss, reflects the profit or loss on your open positions. Essentially, it’s the profit or loss you would make if you were to close your positions at the current market price.

Realized PNL

Realized PNL is the profit or loss made from closed positions. It’s the concrete profit or loss you’ve made from your trading activity – the one that impacts your account balance.

ROI in Crypto Trading Bots

5.1. What are Crypto Trading Bots?

Crypto trading bots are software programs that use algorithms and automation to execute trades in the volatile cryptocurrency market. These bots aim to leverage market fluctuations and execute trades on behalf of the user, potentially generating profits even in a 24/7 trading environment.

5.2. Role of ROI in Crypto Trading Bots

ROI is of utmost importance when utilizing crypto trading bots. By monitoring the ROI of different trading strategies the bots employ, users can identify the most profitable approaches and optimize their trading activities. It allows traders to gauge the performance of their crypto trading bots and make adjustments to enhance returns.

5.3. Impact of Trading Bots on PNL and ROI

Trading bots like those offered by Hinvest.ai can play a crucial role in managing both PNL and ROI. By trading 24/7 and executing trades quickly and accurately based on predefined parameters, these bots can help improve your Realized PNL and ultimately, your ROI. However, their success is largely dependent on the efficiency of the underlying trading strategy.

5.4. What is Hinvest AI and how does it increase ROI?

At Hinvest.ai, we understand the importance of ROI in trading and investing. Our AI-powered crypto trading bot platform is designed to help you maximize your returns with ease. By leveraging advanced algorithms and automation, our bots execute trades in the cryptocurrency market to optimize your ROI. Whether you are an experienced trader or new to the world of crypto, Hinvest.ai provides a user-friendly and efficient solution to enhance your investment performance.

With Hinvest.ai, you can benefit from the strategies mentioned earlier to maximize your ROI. Our platform incorporates risk management techniques, diversified trading options, and technical analysis tools to optimize your trading activities. We prioritize your success and strive to provide you with the best tools and support to navigate the dynamic cryptocurrency market.

In conclusion, ROI is a vital concept in trading and crypto trading bots. It helps traders and investors evaluate the profitability of their investments and make informed decisions to optimize returns. By understanding and effectively utilizing ROI, individuals can navigate the world of finance with confidence and increase their chances of success.

- Ai-Powered Trading Bot

- Ideal for beginners

- Easy-to-use platform

- The low minimum investment required

- Offers a range of trading strategies

- 24/7 customer support

- Limited range of exchanges supported

- Only supports trading in cryptocurrency markets.

Free Trial: Yes

Types of Bots: Ai Smart Bot, Autopilot Bot, DCA Bot, Hodl bot, Trend bot, Market Spot, Futures, and Customizable Bots

Mobile Apps: Coming soon

Exchanges: Binance, Bybit, Bitget, OKX, Kucoin, Gate

In summary, the Hinvest.ai bot offers a powerful and reliable alternative to traditional copy trading. With its advanced algorithmic trading strategies, enhanced speed and efficiency, customizable parameters, comprehensive market analysis, and robust risk management, traders can access a sophisticated trading tool that maximizes their potential for profit in the dynamic cryptocurrency market.

Strategies to Maximize ROI in Trading

To maximize ROI in trading, traders employ various strategies to minimize risks and maximize profits. Here are three essential strategies:

6.1. Risk Management

Proper risk management techniques, such as setting stop-loss orders and diversifying investments, can help protect against significant losses. By managing risk effectively, traders can safeguard their capital and improve their chances of achieving higher ROI.

6.2. Diversification

Diversifying investments across different assets, markets, or cryptocurrencies can help reduce the impact of volatility on overall portfolio performance. By spreading investments, traders can mitigate losses and increase the chances of achieving a higher average ROI.

6.3. Technical Analysis

Technical analysis tools and indicators can assist traders in identifying trends, patterns, and potential market movements. By using these tools to make informed trading decisions, traders can enhance their ROI by capitalizing on favorable market conditions.

Conclusion

Visit Hinvest.ai today to unlock the power of AI-driven crypto trading bots and take your investment journey to new heights.

Frequently Asked Questions (FAQs)

Q1. How can I calculate ROI for multiple investments?

To calculate ROI for multiple investments, sum up the gains and losses for each investment and divide the total by the sum of the initial investments. Multiply the result by 100 to obtain the ROI as a percentage.

Q2. Are crypto trading bots always profitable?

Crypto trading bots can be profitable; however, profitability depends on various factors such as market conditions, the effectiveness of the trading strategy employed by the bot, and risk management techniques.

Q3. Is a higher ROI always better?

A higher ROI is generally desirable; however, it should be considered alongside other factors such as risk, time horizon, and investment goals. A higher ROI may come with increased risks or require a longer investment period.

Q4. Can I use ROI to compare different trading strategies?

Yes, ROI is a useful metric for comparing the performance of different trading strategies. By calculating the ROI for each strategy, traders can assess their effectiveness and choose the one that generates the highest returns.

Q5. Should I solely rely on ROI when making investment decisions?

While ROI is an important metric, it should not be the sole factor for making investment decisions. Other factors such as risk, market conditions, and personal financial goals should also be considered to make well-informed investment choices.