Are you interested in trading but unsure of how to analyze the markets? Technical analysis is a powerful tool used by traders to make informed decisions.

In this beginner’s guide, we will cover the basics of technical analysis, key concepts, support and resistance, technical indicators, chart patterns, applications in different markets, AI crypto trading bots, risk management, and developing a technical analysis strategy.

Introduction: The Power of Technical Analysis

Welcome to the world of technical analysis! As a beginner, you might wonder what this technique entails and how it can help you in your trading journey.

Technical analysis is a trading discipline that uses historical price data to forecast future price movements. It is based on the idea that the past behavior of a security’s price can be used to predict its future behavior.

In this comprehensive guide, we’ll explore the essential concepts and tools of technical analysis, from price charts to technical indicators, and discuss how to develop a strategy that suits your needs. Let’s dive in!

Understanding the Basics of Technical Analysis

Technical analysis is a method used by traders to predict future price movements based on historical price data. This approach aims to identify patterns and trends that can be used to make informed decisions about when to buy or sell an asset.

The Role of Technical Analysis in Trading

By analyzing historical price data, technical analysts can identify patterns and trends that may suggest future price movements. This information is crucial for traders, as it can help them make more informed decisions about when to enter or exit a trade.

Technical vs. Fundamental Analysis: What’s the Difference?

Technical analysis differs from fundamental analysis, which focuses on the underlying value of an asset based on factors such as financial statements, economic indicators, and management quality. While fundamental analysis aims to determine the intrinsic value of an asset, technical analysis is more concerned with its price behavior.

Key Concepts in Technical Analysis

Price Charts: The Foundation of Technical Analysis

Price charts provide a visual representation of an asset’s historical price data. They are the foundation of technical analysis, as they allow traders to identify patterns and trends that can inform their trading decisions.

Types of Price Charts: Line, Bar, and Candlestick

Several types of price charts are used in technical analysis, including line charts, bar charts, and candlestick charts. Line charts display the closing prices of an asset over time, while bar charts show the open, high, low, and close prices for a specific period. Candlestick charts are similar to bar charts but offer more visual information about price movements, making them popular among technical analysts.

Timeframes: Short-term, Medium-term, and Long-term Analysis

Technical analysts study price charts across various timeframes to capture short-term, medium-term, and long-term trends. Short-term analysis typically focuses on intraday or daily price data, while medium-term analysis may examine weekly or monthly data. Long-term analysis usually involves looking at yearly or multi-year price data to identify overarching trends.

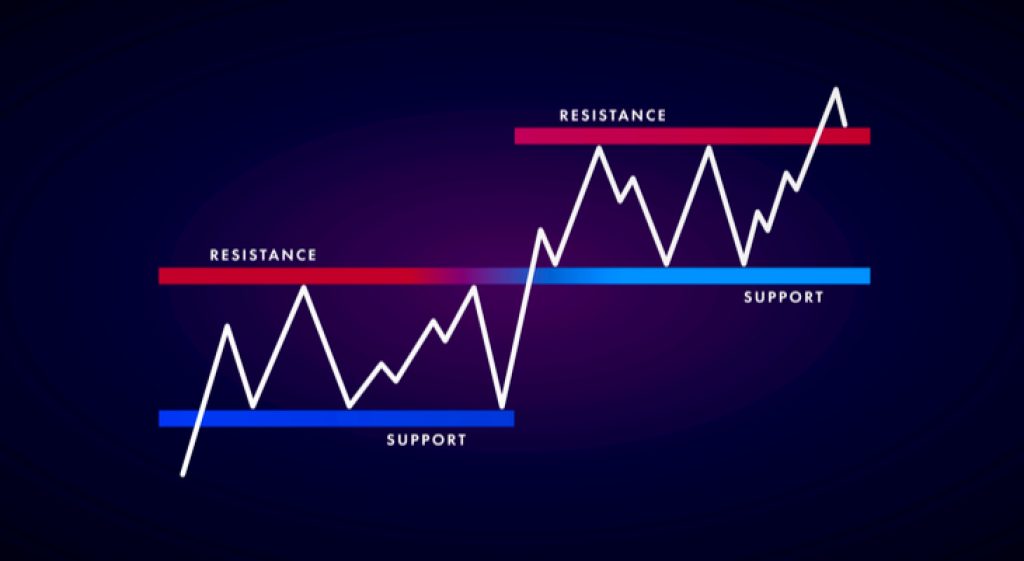

Support and Resistance: Cornerstones of Technical Analysis

Identifying Support and Resistance Levels

Support and resistance are critical concepts in technical analysis. Support levels represent price points where buying pressure is strong enough to prevent further price declines, while resistance levels indicate areas where selling pressure is sufficient to halt price advances. Identifying these levels can help traders determine trades’ potential entry and exit points.

The Psychology Behind Support and Resistance

The psychology behind support and resistance levels stems from the behavior of market participants. When an asset reaches a support level, buyers often perceive it as undervalued, leading to increased demand and upward pressure on the price. Conversely, when an asset reaches a resistance level, sellers may view it as overvalued, resulting in increased supply and downward pressure on the price.

Trendlines and Channels: Tracking Price Movements

Trendlines are lines drawn on a price chart to connect a series of lows or highs, representing support or resistance levels, respectively. A price channel is formed when parallel trendlines can be drawn to connect both support and resistance levels. Channels help traders visualize the direction of the market and identify potential trading opportunities.

Technical Indicators: Tools for Informed Decisions

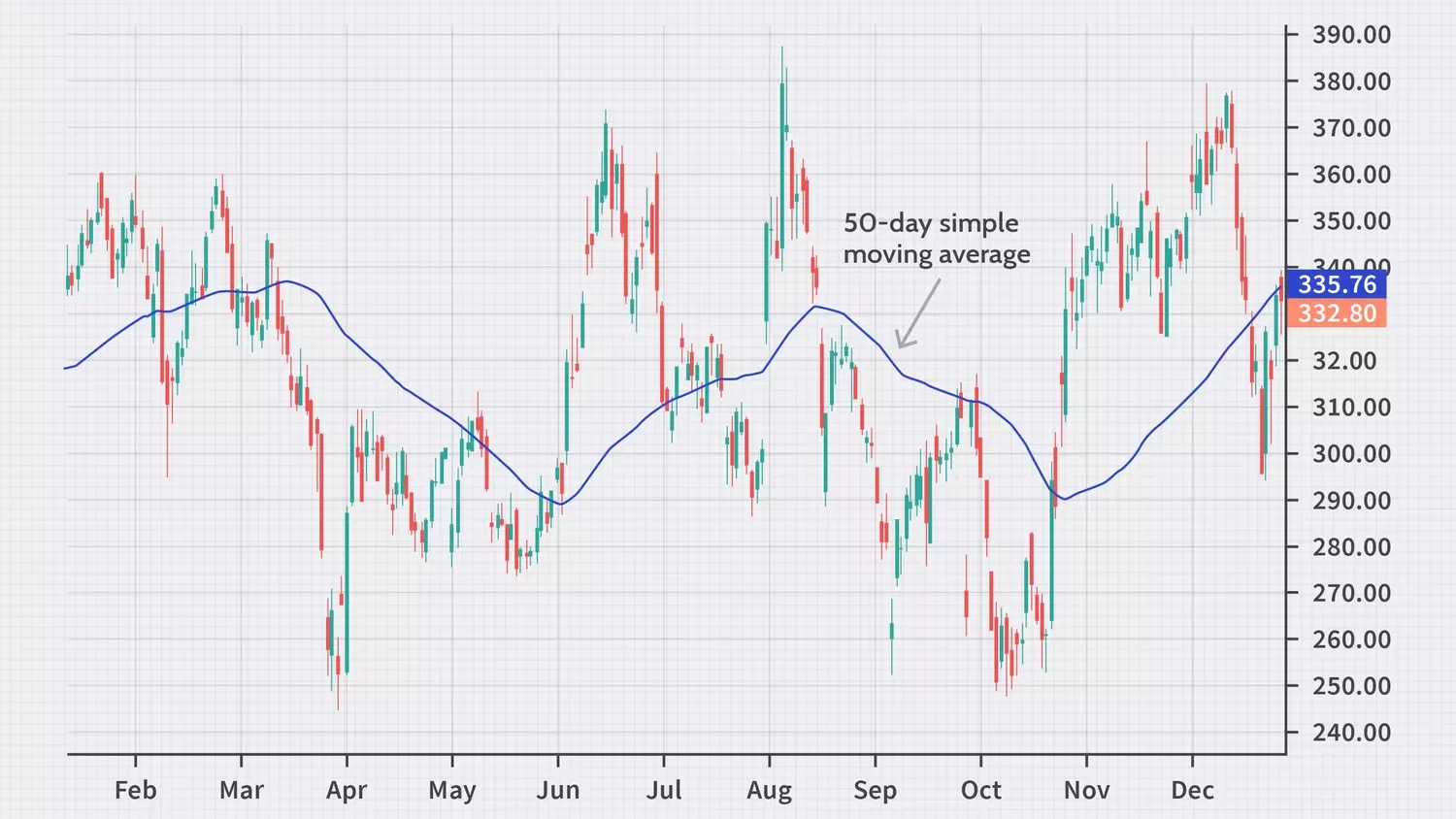

Moving Averages: Smoothing Out Price Data

Moving averages are widely used technical indicators that help smooth out price data and reveal underlying trends. They calculate the average price of an asset over a specific period, with the most common types being simple moving averages (SMAs) and exponential moving averages (EMAs). Moving averages can act as dynamic support or resistance levels, and crossovers between different moving averages may signal trend changes.

Momentum Indicators: Gauging Market Strength

Momentum indicators measure the rate of change in an asset’s price, helping traders determine the strength of a trend. Popular momentum indicators include the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD). These indicators can help identify potential trend reversals and overbought or oversold conditions.

Oscillators: Analyzing Overbought and Oversold Conditions

Oscillators are technical indicators that fluctuate between defined ranges, indicating overbought or oversold conditions. Common oscillators include the RSI and the Stochastic Oscillator. These indicators can provide valuable insight into potential trend reversals and optimal entry or exit points for trades.

Chart Patterns: Visual Clues to Market Direction

Reversal Patterns: Signs of a Trend Change

Reversal patterns are chart formations that suggest an impending change in the direction of a trend. Examples of reversal patterns include the head and shoulders, double tops and bottoms, and triple tops and bottoms. Recognizing these patterns can help traders anticipate trends and adjust their positions accordingly.

Continuation Patterns: Confirming the Trend

Continuation patterns indicate that a trend is likely to continue after a period of consolidation or retracement. Common continuation patterns include flags, pennants, and triangles. Identifying these patterns can allow traders to enter or add to existing positions in the direction of the prevailing trend.

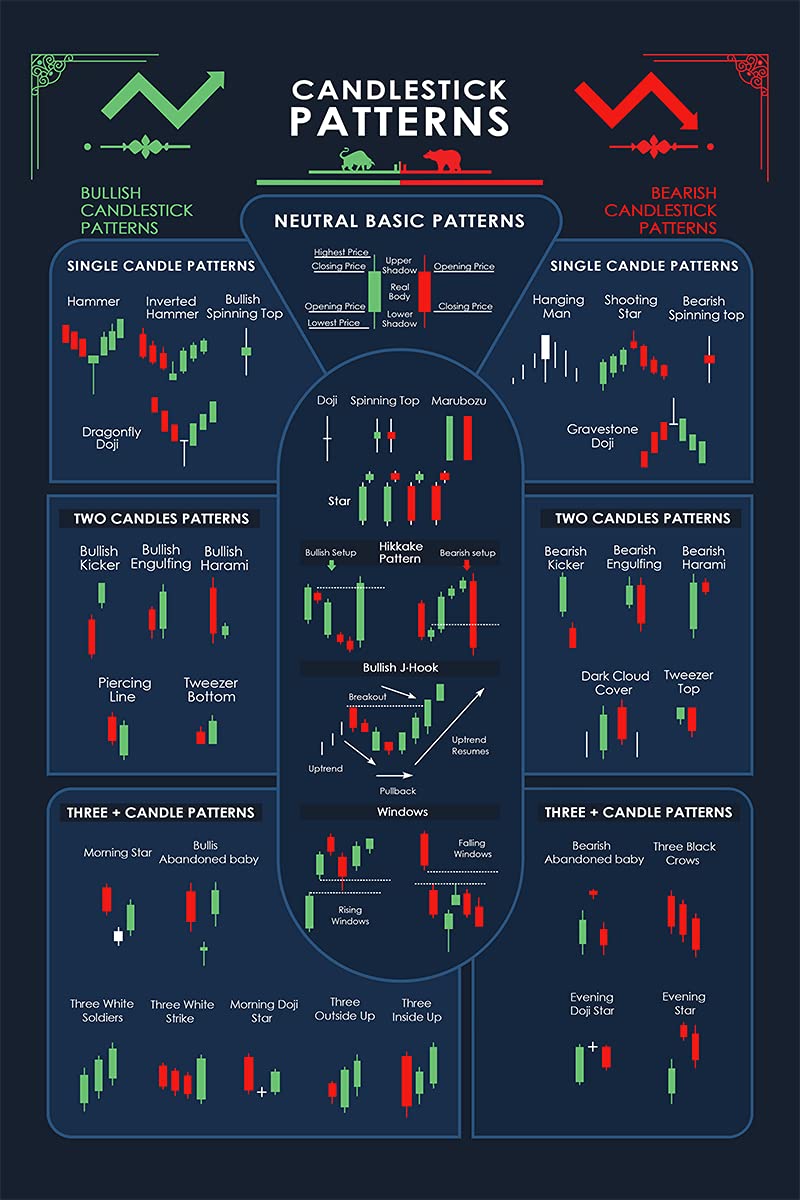

Candlestick Patterns: The Art of Japanese Charting

Basics of Candlestick Charting

Candlestick charting is a Japanese technique that provides a detailed visual representation of price movements within a specific timeframe. Each candlestick represents the open, high, low, and close prices for a period, with the body of the candle indicating the difference between the opening and closing prices. The color of the candlestick depends on whether the closing price is higher or lower than the opening price.

Important Candlestick Patterns to Recognize

Several candlestick patterns are considered significant in technical analysis, as they can signal potential trend reversals or continuations. Some key patterns include:

- Hammer and Hanging Man: These patterns suggest a potential bullish or bearish reversal, depending on the context in which they appear.

- Bullish and Bearish Engulfing: These patterns indicate a potential trend reversal, with the bullish engulfing suggesting a shift from a downtrend to an uptrend and the bearish engulfing indicating the opposite.

- Morning Star and Evening Star: These three-candle patterns signal potential trend reversals, with the morning star suggesting a bullish reversal and the evening star hinting at a bearish reversal.

Technical Analysis Applications: Crypto, Forex, or Stocks?

Comparing Technical Analysis in Different Markets

Technical analysis can be applied to various markets, including cryptocurrencies, forex, and stocks. While the fundamental principles of technical analysis remain the same across these markets, each has unique characteristics that can influence the effectiveness of certain techniques or indicators.

Tailoring Your Approach for Crypto, Forex, and Stock Trading

To adapt your technical analysis approach to different markets, consider the following factors:

- Market volatility: Cryptocurrencies tend to be more volatile than forex and stocks, which can affect the reliability of certain indicators or patterns.

- Market hours: Forex markets operate 24 hours a day, while stock markets have set trading hours, which can impact the analysis of intraday price data.

- Market-specific factors: Each market has unique drivers, such as macroeconomic events for forex or company news for stocks, which can influence price movements and should be considered alongside technical analysis.

Market-Specific Considerations and Tips

When applying technical analysis to different markets, consider these tips:

- Adapt your timeframes: Adjust the timeframes of your analysis to suit the market’s characteristics, such as using shorter timeframes for more volatile assets like cryptocurrencies.

- Combine approaches: Use a combination of technical and fundamental analysis to gain a comprehensive understanding of the market and asset you’re trading.

- Stay informed: Stay updated on market-specific news and events influencing price movements and your technical analysis.

AI Crypto Trading Bots: Revolutionizing Technical Analysis

Understanding AI Crypto Trading Bots

AI crypto trading bots are automated trading systems that use artificial intelligence and machine learning algorithms to analyze market data, identify trading opportunities, and execute trades on behalf of the user. These bots leverage technical analysis to make informed decisions and adapt to real-time market conditions.

How Technical Analysis Powers AI Trading Strategies

AI trading bots rely on technical analysis to generate trading signals and make decisions. By processing vast amounts of historical price data, these bots can identify patterns, trends, and relationships that may not be apparent to human traders. This information can then be used to inform the bot’s trading strategy and improve its overall performance.

Pros and Cons of Using AI Crypto Trading Bots

AI crypto trading bots offer several advantages, such as increased speed, efficiency,and the ability to operate 24/7. They can also eliminate human emotions from the trading process, which may lead to more rational decision-making. However, there are also potential downsides, such as:

- Reliance on historical data: AI trading bots base their decisions on historical data, which may not always accurately predict future price movements.

- Technical issues: Bots can experience technical issues, such as software bugs or connectivity problems, which can impact their performance.

- Cost: Some AI trading bots require a subscription fee or upfront investment, which may not be suitable for all traders.

The Best AI Crypto Trading Bot

Hinvest.ai is an AI-powered trading bot that can help traders make profitable trades. Here’s how it works:

Explanation of Hinvest.ai

Hinvest.ai is an AI-powered trading bot that uses advanced algorithms to analyze market trends and make trading decisions. It can execute trades automatically based on predefined criteria.

- Ai-Powered Trading Bot

- Ideal for beginners

- Easy-to-use platform

- The low minimum investment required

- Offers a range of trading strategies

- 24/7 customer support

- Limited range of exchanges supported

- Only supports trading in cryptocurrency markets.

Free Trial: Yes

Types of Bots: Ai Smart Bot, Autopilot Bot, DCA Bot, Hodl bot, Trend bot, Market Spot, Futures, and Customizable Bots

Mobile Apps: Coming soon

Exchanges: Binance, Bybit, Bitget, OKX, Kucoin, Gate

In summary, Hinvest is the best option for beginners who are looking for a simple and user-friendly way to automate their crypto trading strategies.

With its AI-powered technology, the bot is able to make informed trading decisions, reducing the risk of human error and maximizing profits.

Its low minimum investment and range of trading strategies also make it an ideal choice for those new to the industry and wanting to get started with minimal risk. Additionally, the 24/7 customer support offered by Hinvest ensures that users can get help whenever needed, making it a reliable and trustworthy option.

Risk Management in Technical Analysis

Setting Stop Losses and Profit Targets

Risk management is a crucial aspect of any trading strategy, including those based on technical analysis. One common risk management technique involves setting stop losses and profit targets for each trade. Stop losses help limit potential losses by automatically closing a trade when the price reaches a predetermined level. At the same time, profit targets lock in gains by closing the trade once the desired profit level is reached.

Position Sizing: Balancing Risk and Reward

Another critical risk management practice is position sizing, which involves determining the appropriate amount of capital to allocate to each trade based on your risk tolerance and overall trading strategy. By managing your position sizes, you can balance risk and reward, ensuring that your potential losses are manageable and aligned with your overall trading goals.

Developing a Technical Analysis Strategy

Combining Technical Tools for a Holistic Approach

Developing a successful technical analysis strategy often involves combining various technical tools, such as price charts, indicators, and patterns, to understand the market comprehensively. By using multiple tools, you can increase the likelihood of identifying accurate and reliable trading signals.

Backtesting: Refining Your Strategy with Historical Data

Backtesting is the process of applying your technical analysis strategy to historical price data to evaluate its effectiveness. By analyzing the performance of your strategy in different market conditions, you can identify potential improvements and refine your approach before applying it to live trading.

Conclusion:

FAQs

Is technical analysis applicable to all types of assets?

Technical analysis can apply to various asset classes, including cryptocurrencies, forex, stocks, and commodities.

Can I rely solely on technical analysis for my trading decisions?

While technical analysis can provide valuable insights, combining it with other forms of analysis, such as fundamental analysis, is generally recommended to make more informed trading decisions.

How can I improve my technical analysis skills?

Continual learning and practice are key to improving your technical analysis skills. Consider attending webinars, enrolling in courses, reading books, and engaging with experienced traders in online communities.

What is the best timeframe for technical analysis?

There is no one-size-fits-all answer to this question, as the optimal timeframe for technical analysis will depend on your trading goals and personal preferences. Experiment with different timeframes to determine which works best for your specific approach.

Are there any limitations to technical analysis?

Technical analysis is not infallible and relies on historical data, which may not always accurately predict future price movements. Additionally, it is subject to the interpretation of the analyst, which can introduce biases and errors.