Introduction

Trading in financial markets such as cryptocurrencies, forex, and stocks can be rewarding if done correctly. An essential aspect that often determines a trader’s success is risk management. This article will discuss risk management, its importance in various trading markets, and techniques and tools to help traders manage risk effectively.

What is Risk Management?

Risk management is the process of identifying, assessing, and mitigating potential losses in trading activities. It involves developing and implementing strategies to minimize the impact of unfavorable market movements on a trader’s portfolio, protecting their capital, and ensuring long-term trading success.

Risk Management in Different Markets

A. Crypto Trading

Cryptocurrency trading is known for its high volatility, making risk management crucial for traders in this market. Effective risk management involves allocating capital wisely among various cryptocurrencies, setting appropriate stop-loss orders, and adjusting positions to limit exposure to sudden market swings.

B. Forex Trading

Risk management is essential in the forex market due to the potential for significant currency-value fluctuations. Traders must use appropriate position sizing, stop losses, and diversification techniques to protect their capital from unexpected market movements.

C. Stock Trading

Risk management in stock trading involves allocating funds among different stocks, sectors, or asset classes to achieve a well-diversified portfolio. Traders must monitor their investments and make necessary adjustments to minimize exposure to market risks and optimize their portfolio’s performance.

Importance of Risk Management

Risk management is crucial for several reasons:

- It helps traders protect their capital from excessive losses.

- It enables traders to maximize returns on investments while controlling risks.

- It aids in maintaining a balanced and diversified portfolio, reducing the impact of market volatility.

- It allows traders to stay in the game longer by preventing account depletion due to poor trading decisions or market conditions.

Risk Management Techniques

A. Setting Stop Losses

Stop-loss orders are predetermined exit points set by traders to limit their losses in case the market moves against them. Stop losses help protect a trader’s capital by automatically closing a losing position when the market reaches a specified level.

B. Position Sizing

Position sizing is the process of determining the appropriate size of a trade based on the trader’s account size and risk tolerance. With a fixed percentage or a fixed dollar amount, traders can limit their exposure and protect their capital from excessive losses.

C. Diversification

Diversification is the practice of spreading investments across various assets, sectors, or asset classes to reduce overall portfolio risk. A well-diversified portfolio can better withstand market fluctuations and protect the trader’s capital.

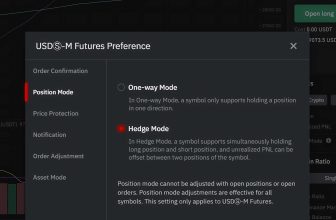

D. Hedging

Hedging involves taking an offsetting position in a related security or asset to protect against potential losses in the original investment. For example, a trader might buy options on a stock they own to limit potential losses if its price declines.

Risk Management Tools and Software

Various tools and software can assist traders in managing risk effectively:

- Trading platforms with built-in risk management features.

- Risk management calculators that determine optimal position sizes based on risk tolerance and account size.

- Charting tools that help identify trends, support and resistance levels, and other technical indicators to inform trading decisions.

- Algorithmic trading tools that automate risk management strategies.

Tips for Effective Risk Management

- Develop a clear trading plan with predefined risk management rules.

- Set realistic expectations for returns and risk.

- Use appropriate position sizing and stop losses to limit exposure.

- Diversify your portfolio across various assets, sectors, or asset classes.

- Continuously learn and improve your risk management skills.

Common Risk Management Mistakes

- Overtrading can lead to excessive risk exposure and account depletion.

- Failing to set stop losses or adjust them appropriately.

- Not diversifying the portfolio sufficiently leads to concentration risk.

- Underestimating the importance of risk management in trading success.

- Not adhering to a predefined trading plan or risk management strategy.

Frequently Asked Questions (FAQs)

What is the primary goal of risk management in trading?

The primary goal of risk management in trading is to protect a trader’s capital by identifying, assessing, and mitigating potential losses in trading activities.

How does diversification help in risk management?

Diversification helps risk management by spreading investments across various assets, sectors, or asset classes, reducing overall portfolio risk. A well-diversified portfolio can better withstand market fluctuations and protect the trader’s capital.

Can I use software or tools to assist in risk management?

Various tools and software can assist traders in managing risk effectively, such as trading platforms with built-in risk management features, calculators, charting tools, and algorithmic trading tools.

What are some common risk management mistakes made by traders?

Some common risk management mistakes traders make include overtrading, failing to set stop losses or adjust them appropriately, not diversifying the portfolio sufficiently, underestimating the importance of risk management, and not adhering to a predefined trading plan or risk management strategy.

How can I improve my risk management skills?

To improve your risk management skills, continuously learn and educate yourself on various risk management techniques, develop a clear trading plan with predefined risk management rules, and use appropriate tools and software to manage risk effectively.