Introduction

Trading in financial markets such as crypto, forex, and stocks can be profitable if done correctly. One essential aspect that often determines a trader’s success is capital management. This article will discuss capital management, its importance in various trading markets, and strategies and tools to help traders manage their capital effectively.

What is Capital Management?

Capital management is the process of managing the financial resources invested in trading assets to maximize returns while minimizing risks. It involves the strategic allocation and distribution of capital, risk assessment, and implementation of strategies to preserve and grow the trading account.

Capital Management in Different Markets

A. Crypto Trading

In the world of cryptocurrency trading, capital management is crucial due to the market’s high volatility. Traders must allocate their capital wisely among various cryptocurrencies, manage risk effectively, and adjust their positions to maintain a balanced portfolio.

B. Forex Trading

Forex trading involves buying and selling currencies; capital management is vital to navigating the market’s fluctuations. Traders must use proper risk management techniques, such as setting stop losses and limiting position sizes, to protect their capital from unexpected market movements.

C. Stock Trading

Capital management in stock trading involves allocating funds among different stocks, sectors, or asset classes to achieve a well-diversified portfolio. Traders must monitor their investments and make necessary adjustments to optimize their portfolio’s performance while managing risks.

Importance of Capital Management

Capital management is essential for several reasons:

- It helps traders protect their capital from excessive losses.

- It aids in optimizing returns on investments.

- It ensures a balanced and diversified portfolio, reducing the impact of market volatility.

- It helps traders stay in the game longer by preventing account depletion due to poor trading decisions or market conditions.

Basic Capital Management Strategies

A. Position Sizing

Position sizing is the process of determining the appropriate size of a trade based on the trader’s account size and risk tolerance. With a fixed percentage or a fixed dollar amount, traders can limit their exposure and protect their capital from excessive losses.

B. Risk Management

Risk management involves identifying, assessing, and mitigating potential losses in trading activities. Techniques such as setting stop-loss orders, using trailing stops, and establishing risk-reward ratios can help traders manage risks effectively.

C. Diversification

Diversification is the practice of spreading investments across various assets, sectors, or asset classes to reduce overall portfolio risk. A well-diversified portfolio can withstand market fluctuations better than a concentrated one, ultimately protecting the trader’s capital.

Advanced Capital Management Techniques

A. Dynamic Position Sizing

Dynamic position sizing adjusts the size of a trade based on market conditions, account performance, or the trader’s risk appetite. This technique can help traders optimize their returns while adapting to changing market conditions.

B. Portfolio Rebalancing

Portfolio rebalancing involves adjusting a portfolio’s asset allocation to maintain its target risk level and asset allocation. Regular rebalancing ensures the portfolio aligns with the trader’s investment goals and risk tolerance.

Capital Management Tools and Software

Various tools and software can assist traders in managing their capital effectively:

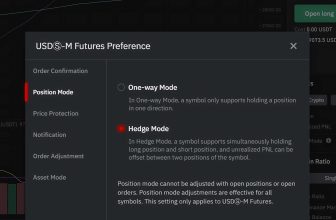

- Trading platforms with built-in risk management features.

- Portfolio management software that tracks and analyzes portfolio performance.

- Risk management calculators that determine optimal position sizes based on risk tolerance and account size.

- Algorithmic trading tools that automate capital management strategies.

Tips for Successful Capital Management

- Set realistic expectations regarding returns and risks.

- Establish a clear trading plan with predefined capital management rules.

- Monitor and review your portfolio performance regularly.

- Stay disciplined and adhere to your capital management strategies.

- Continuously learn and improve your capital management skills.

Frequently Asked Questions (FAQs)

What is the primary purpose of capital management in trading?

The primary purpose of capital management in trading is to maximize returns while minimizing risks by strategically allocating and distributing capital among various assets, assessing risks, and implementing strategies to preserve and grow the trading account.

How does diversification help in capital management?

Diversification helps in capital management by spreading investments across various assets, sectors, or asset classes, reducing overall portfolio risk. A well-diversified portfolio can better withstand market fluctuations and protect the trader’s capital.

Can I use software or tools to assist in capital management?

Yes, various tools and software can assist traders in managing their capital effectively, such as trading platforms with built-in risk management features, portfolio management software, risk management calculators, and algorithmic trading tools.

How often should I rebalance my portfolio?

The frequency of portfolio rebalancing depends on the trader’s preferences and market conditions. Some traders rebalance their portfolios quarterly or annually, while others may do it more frequently based on changes in market conditions or their investment goals.

What are some common mistakes traders make in capital management?

Some common mistakes in capital management include overtrading, risking too much on a single trade, lack of diversification, not setting stop losses, and not following a predefined trading plan.