Trading, in both traditional markets and the burgeoning crypto scene, comes with its language. This can be daunting for newcomers, particularly when terms like Profit and Loss (PNL), Unrealized PNL, Realized PNL, and ROI are thrown around. Understanding these key financial metrics is crucial to maximizing your investment potential, whether through direct trading or crypto trading bots.

Introduction

Importance of Understanding PNL in Trading and Crypto Trading Bots

The Profit and Loss (PNL) concept is a fundamental building block of any trading strategy. It gives you a clear picture of your financial performance, aiding you in making more informed investment decisions. PNL holds an even more prominent place in crypto trading bots, as these automated tools use this metric to assess trading performance and tweak their algorithms.

Overview of PNL (Profit and Loss) and Its Significance

PNL, short for Profit and Loss, measures how much your portfolio has gained or lost over a specified period. Understanding your PNL helps you track your investment performance, manage risk, and optimize your financial strategy in trading.

Introduction to Unrealized PNL, Realized PNL, and ROI

Unrealized PNL, Realized PNL, and ROI are all critical financial concepts in trading. But how are they defined? And, more importantly, how do they relate to each other? Let’s dive in.

PNL (Profit and Loss) Explained

A. Definition and Concept of PNL

PNL stands for Profit and Loss, a financial metric that quantifies the gain or loss made by an investment over a particular period. It’s calculated by subtracting the initial investment from the current value of the investment.

B. Understanding P/L (Profit and Loss) in Trading and Crypto

PNL gives investors insights into their investment performance in both traditional trading and crypto markets. It allows traders to track the profitability of their trades and helps crypto bot algorithms determine the success of their trading strategies.

C. Key Components of PNL Calculation

The primary components for calculating PNL are the initial investment cost, the current or exit value of the investment, and any costs related to maintaining the investment, like trading fees.

Unrealized PNL: Evaluating Potential Profits and Losses

A. Definition and Significance of Unrealized PNL

Unrealized PNL represents the potential profits or losses from an open position. These are theoretical earnings based on the current market value of your investments, which are not “realized” until you close the position.

B. Factors Affecting Unrealized PNL

1. Market Volatility and Fluctuations

Market volatility greatly influences your Unrealized PNL. As the market price fluctuates, so does the potential profit or loss from your open positions.

2. Open Positions and Their Impact on Unrealized PNL

The impact of open positions on Unrealized PNL cannot be overstated. These positions contribute to your unrealized profits or losses until they are closed.

C. Analyzing Unrealized PNL in Trading and Crypto Trading Bots

Unrealized PNL is a crucial metric in assessing the potential return of an investment in both traditional trading and crypto trading bots. It’s a live performance indicator, giving you a snapshot of your potential gains or losses at any given moment.

Realized PNL: Assessing Actual Profits and Losses

A. Definition and Importance of Realized PNL

Realized PNL refers to your profits or losses when a trade is closed. Unlike Unrealized PNL, which is hypothetical, Realized PNL is the concrete result of your trading actions.

B. Factors Influencing Realized PNL

1. Trade Execution and Timing

The timing of trade execution greatly influences your Realized PNL. Exiting a position at the optimal moment can maximize your profits and minimize losses.

2. Transaction Costs and Fees

Transaction costs and fees are often overlooked factors that can significantly affect your Realized PNL. It’s essential to factor these into your trading strategy to ensure accurate PNL calculation.

C. Evaluating Realized PNL for Performance Analysis

Realized PNL is an excellent measure of your trading performance. By comparing your Realized PNL to your initial investment, you can evaluate the success of your trading strategy and make necessary adjustments.

Unrealized PNL vs. Realized PNL: Key Differences and Comparisons

A. Understanding Unrealized PNL and Realized PNL Distinctions

The primary distinction between Unrealized and Realized PNL lies in their state: Unrealized PNL represents potential earnings from open positions. Realized PNL accounts for the gains or losses when a position is closed.

B. Assessing Pros and Cons of Unrealized PNL and Realized PNL

Each PNL type comes with its own set of pros and cons. Unrealized PNL allows for continuous assessment of open positions, while Realized PNL offers concrete results of your trading activities.

C. Case Studies: Comparing Unrealized PNL and Realized PNL Scenarios

Unrealized PNL can swing drastically in volatile markets, providing a dynamic view of potential earnings. In contrast, Realized PNL only changes when a position is closed, providing a stable measure of trading performance.

ROI (Return on Investment) in Trading and Crypto Trading Bots

A. Introduction to ROI and Its Significance

Return on Investment (ROI) is a popular metric used in finance to evaluate the profitability of an investment. ROI measures the return of an investment relative to its cost, expressed as a percentage.

B. Calculating ROI: Methods and Formulas

ROI is calculated by subtracting the initial investment from the final value, dividing the result by the initial investment, and multiplying by 100 to get a percentage.

C. Analyzing ROI in Trading and Crypto Trading Bot Strategies

In both traditional trading and crypto trading bots, ROI helps measure the efficiency of your investments. A higher ROI indicates a more profitable investment.

ROI in Trading vs. ROI in Crypto Trading Bots

A. ROI in Traditional Trading: Factors and Considerations

In traditional trading, ROI is influenced by several factors, including the initial investment amount, the investment duration, and the performance of the underlying assets.

B. ROI Potential with Crypto Trading Bots: Advantages and Challenges

Crypto trading bots offer significant ROI potential because they can operate 24/7, take advantage of market volatility, and execute highly precise trades. However, they also come with challenges, such as the risk of malfunction and market unpredictability.

C. Comparing ROI in Traditional Trading vs. Crypto Trading Bots

While traditional trading relies heavily on human judgment and timing, crypto trading bots use sophisticated algorithms to maximize ROI. Each approach has unique advantages and requires different skills and risk tolerance.

Maximizing PNL and ROI in Trading and Crypto Trading Bots

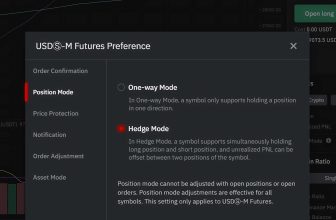

A. Risk Management Strategies for PNL Enhancement

Risk management is crucial in enhancing PNL. By setting stop-loss orders and using hedging techniques, you can limit potential losses and improve your PNL.

B. Leveraging Technical Analysis for Improved ROI

Technical analysis can help predict market trends and improve ROI. Chart patterns, trend lines, and indicators can provide valuable insights into potential trading opportunities.

C. Utilizing Crypto Trading Bots for Optimized PNL and ROI

Crypto trading bots can optimize PNL and ROI through automated trading strategies, precise timing, and continuous operation. However, they should be used with careful oversight and robust risk management.

Hinvest.ai: Leveraging AI for Enhanced PNL and ROI

A. Introduction to Hinvest.ai and its Crypto Trading Bot Platform

Hinvest.ai is a leading crypto trading bot platform that leverages artificial intelligence to maximize PNL and ROI. It offers advanced features, including customized strategies, backtesting, and risk management tools.

B. Benefits of AI-Driven Trading Bots for PNL and ROI

AI-driven trading bots offer significant benefits for PNL and ROI. They can analyze vast amounts of real-time data, execute trades precisely, and adapt to changing market conditions.

C. Case Studies: PNL and ROI Success with Hinvest.ai

Users of Hinvest.ai have reported significant PNL and ROI success. These case studies highlight the platform’s effectiveness and the potential of AI in crypto trading.

- Ai-Powered Trading Bot

- Ideal for beginners

- Easy-to-use platform

- The low minimum investment required

- Offers a range of trading strategies

- 24/7 customer support

- Limited range of exchanges supported

- Only supports trading in cryptocurrency markets.

Free Trial: Yes

Types of Bots: Ai Smart Bot, Autopilot Bot, DCA Bot, Hodl bot, Trend bot, Market Spot, Futures, and Customizable Bots

Mobile Apps: Coming soon

Exchanges: Binance, Bybit, Bitget, OKX, Kucoin, Gate

In summary, the Hinvest.ai bot offers a powerful and reliable alternative to traditional copy trading. With its advanced algorithmic trading strategies, enhanced speed and efficiency, customizable parameters, comprehensive market analysis, and robust risk management, traders can access a sophisticated trading tool that maximizes their potential for profit in the dynamic cryptocurrency market.

Common Challenges and Pitfalls to Avoid

A. Mistakes in PNL Calculation and Analysis

One common mistake is not factoring in all costs in PNL calculations. Considering all relevant expenses, including trading fees and funding costs, is important.

B. Risk Factors and Mitigation Strategies

Risk management is crucial in trading. Use stop-loss orders, diversification, and hedging to mitigate potential losses.

C. Avoiding Overreliance on PNL and ROI Metrics

While PNL and ROI are critical metrics, they shouldn’t be the sole basis for your investment decisions. Consider other factors like risk tolerance, investment goals, and market conditions.

Conclusion

FAQs

What is the difference between Unrealized PNL and Realized PNL?

Unrealized PNL refers to potential profits or losses from open positions, while Realized PNL represents the actual gains or losses once a trade is closed.

How does ROI relate to PNL?

ROI measures the return on an investment relative to its cost. It’s calculated using the PNL and the initial investment amount.

What are some strategies to maximize PNL and ROI?

Risk management, technical analysis, and crypto trading bots can help maximize PNL and ROI.

How does Hinvest.ai help improve PNL and ROI?

Hinvest.ai uses AI-driven trading bots to analyze real-time data, execute trades precisely, and adapt to changing market conditions, improving PNL and ROI.

What are some common mistakes to avoid in PNL calculation and analysis?

Common mistakes include not factoring in all costs, overreliance on PNL and ROI metrics, and failing to employ proper risk management strategies.