If you’re interested in investing or trading, you may have heard of three different markets: cryptocurrency, forex, and stocks. While they all involve buying and selling assets for profit, they have distinct differences in terms of their structure, participants, volatility, and liquidity.

In this article, we’ll dive into the basics of each market and explore their investment and trading strategies, fundamental and technical analysis, risk management, regulation, and taxation. By the end of this article, you’ll have a better understanding of which market suits your goals, preferences, and risk tolerance.

Introduction:

The world of trading offers a wide range of investment opportunities. The most popular among them are cryptocurrencies, foreign exchange (forex), and stocks. Although they share some similarities, each market has its unique characteristics and investment strategies. In this article, we will discuss the key differences between these markets, the pros and cons of each, and how to choose the right one for you.

Understanding the Basics of Each Market

Cryptocurrency Market: Digital Assets and Blockchain

Cryptocurrencies are digital assets that use blockchain technology for secure and decentralized transactions. Examples include Bitcoin, Ethereum, and Litecoin. Blockchain technology allows for transparent and tamper-proof recording of transactions, eliminating the need for intermediaries such as banks.

Forex Market: The Global Currency Exchange

The forex market involves the exchange of one currency for another. It is the world’s largest and most liquid financial market, with daily trading volume exceeding $6 trillion. Participants include banks, central banks, corporations, and individual traders.

Stock Market: Buying Shares in Public Companies

The stock market enables investors to buy and sell shares in publicly traded companies. By purchasing shares, investors become partial owners of the company, giving them the right to a portion of the company’s profits and voting rights on certain corporate decisions.

Market Structure and Participants

How Crypto, Forex, and Stocks Markets are Organized

Each market has its unique structure and organization. The cryptocurrency market operates primarily through decentralized exchanges, while the forex market is a network of banks and brokers connected through an electronic trading platform. On the other hand, the stock market is organized around stock exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ.

In the case of crypto, forex, and stocks, the following entities are involved:

- Crypto: miners, developers, investors, traders, exchanges, wallets, regulators.

- Forex: banks, brokers, hedge funds, corporations, central banks, retail traders.

- Stocks: companies, shareholders, analysts, brokers, exchanges, regulators.

The Role of Exchanges, Brokers, and Market Makers

Exchanges facilitate trading by providing a platform where buyers and sellers can interact. Brokers act as intermediaries, connecting traders with the market and executing trades on their behalf. On the other hand, market makers are financial institutions that provide liquidity by quoting both buy and sell prices, thereby facilitating trade execution.

Trading Hours and Accessibility

24/7 Crypto Trading: A Market That Never Sleeps

The cryptocurrency market operates 24/7, allowing traders to buy and sell digital assets anytime. This non-stop trading environment offers increased opportunities for profit and exposes traders to the risk of sudden market fluctuations.

Forex Trading Sessions: Around the Clock, Five Days a Week

Forex trading occurs 24 hours a day, five days a week, with trading sessions divided into major financial centers like Sydney, Tokyo, London, and New York. Although forex trading is unavailable on weekends, the market’s accessibility still provides ample opportunities for traders to participate.

Stock Market Hours: Limited to Business Days and Trading Sessions

Stock markets have more limited trading hours, typically operating during business days and local trading sessions. These restrictions can limit opportunities for quick trades but may also provide a more stable environment for long-term investors.

Market Volatility and Liquidity

Cryptocurrency Volatility: High-Risk, High-Reward

The cryptocurrency market is known for its high volatility, with prices often experiencing significant fluctuations within short periods. This volatility can present risks and rewards for traders, as large price swings can lead to significant gains or losses.

Forex Liquidity: Trading the World’s Most Liquid Market

The forex market’s high liquidity allows for easy trade execution, even for large orders. This liquidity results from the vast number of participants and the continuous trading of major currency pairs. The high liquidity in forex also contributes to relatively low transaction costs.

Stock Market Stability: Steady Gains and Long-Term Growth

The stock market generally exhibits lower volatility than cryptocurrency, providing a more stable environment for long-term investors. While stock prices can still fluctuate, the overall trend tends to be upward over time, offering steady gains and long-term growth potential.

Investment and Trading Strategies

Crypto Trading: Spot, Margin, and Derivatives

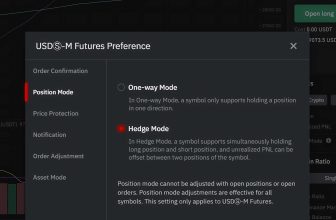

In the cryptocurrency market, traders can trade spot, margin, or derivatives. Spot trading involves the direct exchange of cryptocurrencies, while margin trading allows traders to borrow funds to increase their position size. Derivatives trading involves contracts based on the underlying asset’s value, such as futures and options.

Forex Trading: Going Long, Going Short, and Leverage

Forex traders can take long or short positions, betting on a currency pair’s value to increase or decrease. Additionally, forex traders often use leverage to amplify their returns, allowing them to control larger positions with a smaller initial investment.

Stock Trading: Value Investing, Growth Investing, and Dividends

Stock trading strategies include value investing, growth investing, and dividend investing. Value investors seek undervalued stocks with strong fundamentals, while growth investors focus on companies with high potential for future growth. On the other hand, dividend investors look for companies that consistently pay dividends, providing a steady income stream.

Fundamental Analysis for Each Market

Crypto Fundamentals: Project Analysis and Market Adoption

Fundamental analysis in the cryptocurrency market involves evaluating a project’s technology, team, use case, and market adoption. Investors assess these factors to determine a cryptocurrency’s long-term potential and viability.

Forex Fundamentals: Economic Indicators and Central Banks

Forex fundamental analysis focuses on economic indicators, such as interest rates, inflation, employment data, and central bank policies. These factors can influence currency values and inform trading decisions.

Stock Fundamentals: Earnings Reports and Market Sectors

In the stock market, fundamental analysis involves examining a company’s financial statements, management, industry trends, and market position. Investors use this information to evaluate a company’s overall health and potential for growth.

Technical Analysis in Crypto, Forex, and Stocks

Applying Technical Analysis Across Different Markets

Technical analysis is a method of evaluating assets based on historical price and volume data. Traders use chart patterns, trend lines, and various technical indicators to identify potential entry and exit points for trades. Technical analysis can be applied across crypto, forex, and stock markets, although some indicators may be more effective in specific markets.

Market-Specific Indicators and Chart Patterns

Each market has its unique set of indicators and chart patterns that can be more effective in predicting price movements. For instance, moving averages, relative strength index (RSI), and Bollinger Bands are widely used in all three markets. Still, indicators like the Ichimoku Cloud may be more prevalent in forex trading. Similarly, chart patterns like head and shoulders or double tops and bottoms are common across markets but can have varying levels of reliability depending on the market being analyzed.

Risk Management and Diversification

Balancing Risk Across Crypto, Forex, and Stocks

Managing risk is a crucial aspect of trading and investing. By diversifying your investments across crypto, forex, and stocks, you can reduce the impact of market-specific risks and enhance the overall stability of your portfolio.

The Importance of Portfolio Diversification

Diversifying your portfolio helps spread risk across different asset classes and reduces the impact of individual asset price fluctuations. A well-diversified portfolio is more likely to withstand market downturns and deliver consistent returns over time.

Trading Bots and Their Role in Modern Trading

Understanding Trading Bots: Automation for Success

Trading bots are software programs designed to execute trades automatically based on predefined rules and algorithms. They can help traders capitalize on market opportunities, manage risk, and streamline their trading process.

AI-Powered Crypto Trading Bots: The Future of Trading

AI-powered trading bots utilize artificial intelligence and machine learning to analyze vast amounts of data, identify patterns, and make more informed trading decisions. These advanced bots can adapt to changing market conditions and potentially outperform human traders.

Hinvest: A Revolutionary AI Crypto Trading Bot

Hinvest is an example of an AI-powered crypto trading bot that can help traders optimize their returns in the volatile cryptocurrency market. By leveraging advanced algorithms and machine learning, Hinvest automates trading decisions and can potentially deliver better results than manual trading.

Harnessing the Power of Hinvest for Optimal Returns

Utilizing a tool like Hinvest can help traders navigate the complex cryptocurrency market, manage risk, and improve their overall trading performance.

Explanation of Hinvest.ai

Hinvest.ai is an AI-powered trading bot that uses advanced algorithms to analyze market trends and make trading decisions. It can execute trades automatically based on predefined criteria.

- Ai-Powered Trading Bot

- Ideal for beginners

- Easy-to-use platform

- The low minimum investment required

- Offers a range of trading strategies

- 24/7 customer support

- Limited range of exchanges supported

- Only supports trading in cryptocurrency markets now.

Free Trial: Yes

Types of Bots: Ai Smart Bot, Autopilot Bot, DCA Bot, Hodl bot, Trend bot, Market Spot, Futures, and Customizable Bots

Mobile Apps: Coming soon

Exchanges: Binance, Bybit, Bitget, OKX, Kucoin, Gate

In summary, Hinvest is the best option for beginners who are looking for a simple and user-friendly way to automate their crypto trading strategies.

With its AI-powered technology, the bot is able to make informed trading decisions, reducing the risk of human error and maximizing profits.

Its low minimum investment and range of trading strategies also make it an ideal choice for those new to the industry and wanting to get started with minimal risk. Additionally, the 24/7 customer support offered by Hinvest ensures that users can get help whenever needed, making it a reliable and trustworthy option.

Regulation and Legal Considerations

Crypto Regulation: A Rapidly Evolving Landscape

The regulatory environment for cryptocurrencies is constantly changing, with new rules and guidelines being introduced regularly. Traders and investors must stay informed about the latest regulatory developments to ensure compliance and protect their investments.

Forex Regulation: Ensuring Fair Play in the Currency Market

The forex market is regulated by various government agencies and financial authorities worldwide. These organizations aim to ensure fair play, prevent market manipulation, and protect individual traders.

Stock Market Regulation: Protecting Investors and Maintaining Order

Stock markets are subject to strict regulation and oversight, with governing bodies like the Securities and Exchange Commission (SEC) in the United States ensuring investor protection and market integrity.

Tax Implications and Reporting

Crypto Taxation: Navigating a Complex Arena

Taxation of cryptocurrency transactions can be complex, with different rules and reporting requirements depending on your jurisdiction. It’s essential to consult with a tax professional to ensure compliance with local tax laws.

Forex Taxation: Understanding the Rules for Currency Traders

Forex traders must be aware of the tax implications of their trades, including capital gains, interest income, and expenses. Tax regulations can vary by country, so it’s important to consult with a tax expert familiar with the rules in your jurisdiction.

Stock Taxation: Capital Gains, Dividends, and Deductions

Stock market investors are subject to various taxes, including capital gains tax on profits from selling stocks and taxes on dividend income. Additionally, investors can often claim deductions for expenses related to stock trading, such as brokerage fees and investment research. As with other markets, tax laws vary by country, and consulting a tax professional is essential for compliance.

Conclusion:

To choose the right market for you, consider your investment goals, risk tolerance, and time availability. Research and educate yourself on the fundamentals and technical aspects of each market. Develop a solid trading or investment strategy that aligns with your objectives. Additionally, stay updated on market news, regulatory changes, and taxation requirements to ensure compliance and make informed decisions.

Remember, diversification is key to managing risk effectively. Consider diversifying your portfolio across different markets, asset classes, and trading strategies. This can help mitigate the impact of potential losses and provide opportunities for growth.

Ultimately, the choice between crypto, forex, and stocks depends on your preferences, knowledge, and financial goals. By understanding the unique characteristics of each market and implementing sound trading principles, you can navigate these markets with confidence and increase your chances of success.

FAQs

What are the main differences between crypto, forex, and stock markets?

Crypto markets involve trading digital assets, forex markets deal with global currency exchange, and stock markets involve buying and selling shares of public companies. Each market has its unique characteristics, such as market structure, trading hours, and volatility.

Is it better to trade cryptocurrencies, forex, or stocks?

The best market for you depends on your personal preferences, risk tolerance, and investment goals. Some traders prefer the high volatility and 24/7 trading of the crypto market. In contrast, others might prefer the stability and long-term growth potential of the stock market or the liquidity of the forex market.

Can I trade all three markets at the same time?

Yes, you can trade across multiple markets simultaneously. Diversifying your investments across different markets can help manage risk and potentially improve your overall returns.

What role do trading bots play in modern trading?

Trading bots automate trade execution based on predefined rules and algorithms. They can help traders capitalize on market opportunities, manage risk, and streamline their trading process. AI-powered trading bots, like Hinvest, use machine learning to make more informed trading decisions and adapt to changing market conditions.

How can I stay updated on market regulations and tax implications?

To stay informed about regulatory changes and tax implications, regularly consult reliable financial news sources and government websites, and consult with tax professionals familiar with the rules in your jurisdiction.