Gold has been a valuable asset and a safe-haven investment for centuries. In today’s digital age, owning gold has become even more accessible and convenient through the introduction of tokenized gold assets like Pax Gold (PAXG).

What is Pax Gold (PAXG)?

The concept behind PAXG

Pax Gold is a digital asset backed by physical gold, with each token representing one fine troy ounce of London Good Delivery gold. This innovative concept combines the traditional value of gold with the modern benefits of blockchain technology, making gold ownership more accessible and secure.

Understanding tokenized gold

Tokenized gold is a digital representation of physical gold on a blockchain. By tokenizing gold, it becomes divisible, easily transferable, and more accessible to investors worldwide. Tokenized gold assets, like PAXG, allow individuals to buy, sell, and trade gold without having to deal with the storage and security concerns associated with owning physical gold.

The role of Paxos Trust Company

Paxos Trust Company, a regulated financial institution, is responsible for issuing PAXG tokens. Paxos ensures that each token is backed by physical gold stored in Brink’s vaults in London and New York. This guarantees that PAXG maintains its value and credibility in the market.

How Does Pax Gold Work?

Physical gold backing PAXG

Each PAXG token is backed by one fine troy ounce of physical gold, ensuring its value remains stable and closely tied to the gold market. The gold that backs PAXG is audited regularly to verify its existence and maintain trust in the system.

The process of tokenization

Tokenization involves converting a physical asset, like gold, into a digital token on a blockchain. This process allows gold to be easily traded, transferred, and stored in digital wallets. The blockchain technology underlying PAXG ensures transparency, immutability, and security for token holders.

PAXG and blockchain technology

PAXG utilizes blockchain technology to create a decentralized and secure platform for gold ownership. Transactions involving PAXG are recorded on the Ethereum blockchain, providing transparency and ensuring the integrity of the token.

Benefits of Digital Gold Ownership

Increased accessibility

One of the main benefits of digital gold ownership is its accessibility. Investors can easily purchase and trade tokenized gold assets like PAXG on various cryptocurrency exchanges, making it more convenient than traditional gold investments.

Fractional ownership

PAXG enables fractional ownership, allowing investors to own smaller amounts of gold without needing to buy whole bars or coins. This makes gold investment more affordable and accessible for a broader range of investors.

Enhanced security

Digital gold ownership offers enhanced security compared to physical gold. PAXG is secured on the Ethereum blockchain, making it nearly impossible to counterfeit or manipulate. Investors no longer need to worry about the risks associated with storing and insuring physical gold.

Simplified storage and transfer

With PAXG, investors can easily store their gold holdings in digital wallets, eliminating the need for costly and cumbersome storage solutions. Transferring PAXG to other users is also a simple and fast process, thanks to the efficiency of blockchain technology.

Pax Gold vs. Traditional Gold Investments

Comparing physical gold and PAXG

Physical gold investments typically involve purchasing gold bars or coins, which require secure storage and can be difficult to sell or transfer. PAXG, on the other hand, offers the benefits of gold investment without the hassles of physical ownership. It is easily tradable, divisible, and securely stored on the blockchain.

Gold ETFs vs. PAXG

Gold Exchange-Traded Funds (ETFs) are another popular form of gold investment. However, gold ETFs are subject to management fees and don’t provide direct ownership of physical gold. PAXG offers a more direct and cost-effective way to invest in gold, as it is backed by physical gold and involves lower fees.

Assessing the risks and rewards

While PAXG offers several advantages over traditional gold investments, it is essential to consider the risks and rewards associated with digital gold ownership. PAXG is a relatively new asset, and its long-term performance is still uncertain. It is crucial to carefully evaluate the potential risks and rewards before investing in PAXG or any other digital asset.

How to Buy and Sell PAXG

Supported cryptocurrency exchanges

PAXG can be bought and sold on various cryptocurrency exchanges, such as Binance, Kraken, and Bybit. These exchanges provide a platform for investors to easily trade PAXG with other cryptocurrencies or fiat currencies.

Purchasing PAXG with fiat currency

Some cryptocurrency exchanges allow users to purchase PAXG directly with fiat currency, such as US dollars or euros. This simplifies the process of investing in digital gold, as investors can avoid the need to purchase other cryptocurrencies first.

Step-by-step guide to buying and selling PAXG

- Choose a reputable cryptocurrency exchange that supports PAXG trading.

- Register for an account on the exchange and complete any required verification processes.

- Deposit fiat currency or cryptocurrency into your exchange account.

- Navigate to the PAXG trading pair of your choice and place a buy order.

- Once your order is filled, your PAXG tokens will be available in your exchange account.

- Transfer your PAXG tokens to a secure wallet for long-term storage or keep them on the exchange if you plan to trade frequently.

PAXG Wallets and Storage

Understanding wallet options

PAXG can be stored in various types of wallets, including hardware wallets, software wallets, and even some exchange wallets. It is essential to choose a secure and reliable wallet that supports PAXG to ensure the safe storage of your digital gold.

Hardware wallets for enhanced security

Hardware wallets are physical devices that securely store private keys offline, providing the highest level of security for your PAXG tokens. Some popular hardware wallets that support PAXG include Ledger and Trezor.

Recommendations for popular PAXG wallets

- Ledger Nano S and Ledger Nano X (hardware wallets)

- Trezor One and Trezor Model T (hardware wallets)

- MetaMask (software wallet, browser extension)

- Trust Wallet (mobile wallet)

Pax Gold Use Cases

Wealth preservation

Gold has historically served as a store of value and a hedge against inflation. PAXG allows investors to easily access and preserve their wealth in gold while benefiting from the convenience and security of digital assets.

Diversifying investment portfolios

Adding PAXG to an investment portfolio can help diversify risk and reduce overall volatility. Gold typically has a low correlation with other asset classes, making it an attractive addition to any investment strategy.

Collateral for loans

PAXG can be used as collateral for loans on various DeFi platforms, allowing investors to unlock the value of their digital gold without selling it. This enables them to access liquidity while retaining their exposure to gold.

Spot and Futures Markets for Pax Gold

Introduction to spot trading

Spot trading involves buying and selling PAXG tokens at the current market price. This type of trading is suitable for investors who want to quickly enter or exit positions and capitalize on short-term price fluctuations.

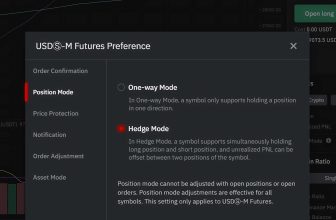

PAXG futures trading explained

Futures trading allows investors to speculate on the future price of PAXG without owning the underlying asset. This can provide opportunities for profit, even in a bearish market. However, futures trading also involves a higher degree of risk and is not suitable for inexperienced investors.

Pros and cons of trading PAXG in spot and futures markets

- Spot trading pros: Instant execution, no expiration dates, straightforward process.

- Spot trading cons: Less leverage, the limited profit potential in bearish markets.

- Futures trading pros: Leverage, the profit potential in bullish and bearish markets, hedging opportunities.

- Futures trading cons: More complex, higher risk, potential for significant losses

Trading Bots for PAXG

What are trading bots?

Trading bots are automated software programs designed to execute trades on behalf of investors. These bots can analyze market data, implement trading strategies, and execute orders quickly and efficiently.

How trading bots can enhance PAXG trading

Using trading bots for PAXG can help investors capitalize on market opportunities and improve their overall trading performance. Bots can execute trades faster than humans and operate 24/7, ensuring investors never miss a profitable trade.

Best PAXG trading bots in the market

Discover the best PAXG trading bot in the market: Hinvest.ai Pax Gold bot, an AI-powered solution designed to optimize your Pax Gold trading experience across multiple platforms. Offering impressive average monthly profits and supporting diverse strategies, this user-friendly bot revolutionizes PAXG trading and provides effective risk management. Try Hinvest.ai Pax Gold bot now and enjoy seamless, intelligent, and profitable trading.

PAX Gold Bot Coin Bot

Leveraging PAXG in DeFi Platforms

Earning interest on PAXG

Decentralized finance (DeFi) platforms offer opportunities for PAXG holders to earn interest on their tokens. By depositing PAXG into interest-bearing accounts or lending protocols, investors can generate passive income while maintaining exposure to gold.

Using PAXG as collateral in decentralized lending

Some DeFi platforms allow users to borrow cryptocurrencies or stablecoins using PAXG as collateral. This enables investors to access liquidity without selling their digital gold, which can be particularly beneficial during times of market volatility or for short-term financing needs.

Regulatory Compliance and PAXG

Paxos Trust Company’s regulatory status

Paxos Trust Company, the issuer of PAXG, is a regulated financial institution with a New York State trust charter. This regulatory oversight ensures that Paxos adheres to strict guidelines and standards, providing additional confidence in the PAXG ecosystem.

How PAXG complies with financial regulations

PAXG is designed to comply with various financial regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. Investors may be required to provide personal information and verify their identity when purchasing or redeeming PAXG, ensuring compliance with regulatory standards.

Tax Implications of PAXG Ownership

Understanding tax obligations

Owning and trading PAXG may have tax implications, depending on your jurisdiction. It is essential to consult with a tax professional to understand your tax obligations when investing in digital gold assets like PAXG.

Tips for reporting PAXG transactions

- Keep detailed records of your PAXG transactions, including dates, amounts, and prices.

- Calculate your gains or losses on PAXG trades based on your local tax regulations.

- Report your PAXG transactions on your annual tax return, if required.

- Consult a tax professional for guidance on reporting PAXG transactions and any potential tax deductions or exemptions.

PAXG Price Analysis and Predictions

Factors influencing PAXG price

The price of PAXG is influenced by several factors, including the price of gold, market demand for digital gold assets, and overall market sentiment. It is essential to consider these factors when analyzing PAXG’s price and making investment decisions.

Notable price milestones

Since its launch in 2019, PAXG has experienced several price milestones. As of February 2023, there are over 270,000 PAXG tokens in circulation, with its price typically remaining close to the price of gold.

Expert predictions for PAXG’s future

Predicting the future price of PAXG is challenging, as it depends on various factors, including market sentiment and macroeconomic trends. However, given gold’s historical performance as a store of value, it is possible that PAXG could continue to gain traction as a popular digital gold investment.

Pax Gold Competitors

TetherGold (XAUT)

Tether Gold (XAUT) is another digital gold asset, with each token representing one troy ounce of physical gold. Like PAXG, XAUT offers investors the benefits of digital gold ownership, such as increased accessibility and simplified storage. However, Tether Gold is issued by Tether, a company that has faced controversies in the past, which may impact investor confidence.

Digix Gold Token (DGX)

Digix Gold Token (DGX) is another digital gold asset, with each token representing one gram of gold. DGX provides investors with similar benefits as PAXG and XAUT, such as easy storage and transfer. One key difference is that DGX tokens represent a smaller unit of gold, which may be more suitable for investors looking for fractional gold ownership.

Exploring other digital gold options

There are several other digital gold assets available in the market, each offering unique features and benefits. When considering an investment in digital gold, it is essential to research and compare the available options to make an informed decision.

Common Misconceptions About PAXG

Debunking PAXG myths

Some common misconceptions about PAXG include the belief that it is not backed by physical gold or that it is inherently less secure than traditional gold investments. In reality, each PAXG token represents one fine troy ounce of London Good Delivery gold, stored in secure vaults. Additionally, the security of PAXG depends on the user’s storage practices and choice of wallet.

Clarifying misconceptions about tokenized gold

Tokenized gold is a relatively new concept, and some investors may be skeptical about its potential as an investment. However, tokenized gold assets like PAXG offer a unique combination of the benefits of both digital assets and traditional gold investments, making them an attractive option for diversifying investment portfolios.

Security Concerns and PAXG

Addressing potential security risks

As with any digital asset, there are potential security risks associated with PAXG, such as hacks or wallet vulnerabilities. To mitigate these risks, it is crucial to choose secure wallets and follow best practices for digital asset storage.

Ensuring the safe storage of PAXG

To store PAXG securely, consider using a hardware wallet, which offers the highest level of security by storing private keys offline. Additionally, follow these best practices:

- Keep your wallet software and hardware up to date.

- Enable two-factor authentication (2FA) for any online wallets or exchange accounts.

- Create and store secure backups of your wallet’s private keys.

- Never share your private keys or wallet passwords with anyone.

Conclusion

FAQs

Is PAXG a stablecoin?

While PAXG is designed to track the price of gold closely, it is not considered a stablecoin, as its value can fluctuate with gold’s market price.

Can I redeem PAXG for physical gold?

Yes, PAXG holders can redeem their tokens for physical gold through Paxos Trust Company, subject to minimum redemption requirements and fees.

What is the minimum amount of PAXG I can buy?

You can buy no minimum amount of PAXG, as it can be purchased in fractional amounts, allowing investors to own as little or as much gold as they desire.

Are there any fees associated with PAXG transactions?

There may be fees associated with PAXG transactions, including network fees for sending PAXG and exchange fees for trading PAXG on cryptocurrency exchanges. Additionally, there may be fees for redeeming PAXG for physical gold.

Is PAXG a good investment?

As with any investment, the suitability of PAXG depends on an individual’s investment goals, risk tolerance, and portfolio diversification needs. PAXG can be a valuable addition to an investment portfolio for those seeking exposure to gold and the benefits of digital assets. However, conducting thorough research and considering potential risks before investing is essential.

official site: Link