Introduction

The Birth of Cryptocurrency

Have you ever wondered how the world of digital money, or cryptocurrency, came into existence? Just like the printing press revolutionized the way information was disseminated, the creation of cryptocurrency has forever changed the landscape of financial transactions. Born out of a desire for a decentralized and anonymous form of currency, the concept behind the cryptocurrency has fascinated and perplexed people across the globe.

Picture this: it’s 2008, the world is grappling with a financial crisis, and trust in traditional banking institutions is waning. Enter the enigmatic figure of Satoshi Nakamoto, who published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” What was once just an idea quickly transformed into a groundbreaking invention, as the first-ever cryptocurrency, Bitcoin, was launched in 2009. This digital currency, backed by robust cryptography and a decentralized network, enables peer-to-peer transactions, eliminating the need for intermediaries like banks or payment processors.

Now, imagine a world where financial transactions can be conducted with minimal fees, lightning-fast speeds, and increased privacy. That’s the revolutionary potential of cryptocurrencies. Since the birth of Bitcoin, the crypto market has grown exponentially, introducing a myriad of alternative digital currencies, such as Ethereum, Litecoin, and Ripple, to name just a few. As we navigate the ever-evolving landscape of digital finance, one thing’s for sure: cryptocurrency’s birth has permanently altered how we perceive and interact with money, and there’s no turning back.

The Role of Blockchain

In today’s digital age, the technology behind cryptocurrencies, known as the blockchain, has emerged as a game-changer. Blockchain, a digital ledger that records transactions across multiple computers, offers several key aspects that have the potential to reshape various industries and enhance trust and security in the digital world.

Decentralization

Firstly, decentralization is at the core of blockchain technology. Unlike traditional systems controlled by a central authority, blockchain is maintained by a network of computers, called nodes, that work collaboratively to validate and record transactions. This decentralization eliminates single points of failure and reduces the risk of manipulation or control by a single entity.

Transparency

Secondly, transparency is a defining feature of blockchain. The blockchain ledger is open and accessible for anyone to view, making it challenging for fraudulent activities to go unnoticed. This level of transparency fosters trust among network users, as they can independently verify the legitimacy of transactions and information stored on the blockchain.

Immutability

Lastly, immutability is a critical aspect of blockchain technology. Once a transaction is recorded on the blockchain, it cannot be altered or deleted, providing high security and reliability. This characteristic ensures that historical data remains intact and verifiable, creating an environment of trust and accountability.

In conclusion, blockchain technology, with its decentralized nature, transparency, and immutability, has the potential to revolutionize various industries, enhance trust, and provide a secure foundation for digital interactions. As blockchain continues to evolve and mature, we can expect its applications and impact to expand far beyond the realm of cryptocurrencies.

Types of Cryptocurrencies

In the ever-growing world of digital finance, thousands of cryptocurrencies have emerged, each with unique features and use cases. As new cryptocurrencies continue to be developed, it’s essential to understand some of the most well-known and widely-used digital currencies in the market.

Some of the most well-known cryptocurrencies include:

Bitcoin

Bitcoin, the pioneer of cryptocurrencies, remains the most popular and widely-accepted digital currency. Created to facilitate peer-to-peer transactions without requiring a central authority like a bank, Bitcoin’s scarcity, with a limited supply of 21 million coins, and its competitive mining process contribute to its lasting value and appeal.

Ethereum

Ethereum, on the other hand, is more than just a cryptocurrency. It’s a versatile platform that allows developers to build and deploy decentralized applications (dApps) using smart contracts. Ether, the native cryptocurrency of the Ethereum network, powers these applications and transactions. Ethereum’s adaptability and its role in the burgeoning decentralized finance (DeFi) sector have led to its widespread adoption and popularity.

Altcoins

Altcoins, or alternative cryptocurrencies, emerged after Bitcoin’s success, hoping to capitalize on the growing interest in digital currencies. Examples include Litecoin, Ripple, and Cardano, each offering new features or improvements over Bitcoin to attract users and gain market share.

Stablecoins

Lastly, stablecoins play a crucial role in the cryptocurrency ecosystem by providing a stable store of value. These digital currencies are pegged to real-world assets like the US Dollar to minimize price volatility. Tether (USDT) and USD Coin (USDC) are popular examples of stablecoins, often used for trading and as a safe haven during turbulent market conditions.

In conclusion, understanding the various types of cryptocurrencies and their unique features is essential for anyone looking to navigate the digital currency landscape. As the market continues to evolve, these currencies will likely play a significant role in shaping the future of finance.

Advantages and Disadvantages

Emerging Technologies in the Crypto Space

Cryptocurrencies constantly evolve, with emerging technologies pushing the boundaries of what’s possible within the digital asset ecosystem. Two significant advancements in recent years are non-fungible tokens (NFTs) and the metaverse, both of which are revolutionizing how we interact with and monetize digital assets.

Non-Fungible Tokens (NFTs):

NFTs are unique digital assets representing ownership of a specific item, such as digital art, music, or virtual real estate. Each NFT is distinct and cannot be exchanged one-to-one like cryptocurrencies. They are commonly used in digital collectibles and have gained popularity in various industries, including gaming, entertainment, and art.

The Metaverse:

The metaverse is a virtual universe where users can interact, socialize, and participate in various activities through their digital avatars. Cryptocurrencies and blockchain technology play a significant role in the development of the metaverse, as they enable the creation, ownership, and trade of digital assets within these virtual worlds. Examples of metaverse platforms include Decentraland, The Sandbox, and CryptoVoxels.

How to Get Started with Crypto

The world of cryptocurrencies offers exciting opportunities for those looking to explore digital finance. If you’re considering taking the plunge, here’s a step-by-step guide to help you navigate the process and get started with crypto.

Wallets:

A digital wallet is crucial for managing your cryptocurrencies. It allows you to store, send, and receive digital assets securely. Various types of wallets are available, such as hardware, software, and online wallets. Assess your needs and priorities, and choose a wallet with robust security features and ease of use.

Exchanges:

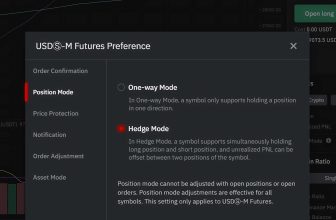

Cryptocurrency exchanges are platforms to buy, sell, or trade digital currencies.

Some popular exchanges include Coinbase, Binance, and Bybit. When selecting an exchange, consider factors such as user experience, the range of available cryptocurrencies, fees, and security infrastructure. Always research and compare multiple exchanges before making a decision.

Research and Education:

Before investing in cryptocurrencies, it’s vital to educate yourself about the market, the technology, and the risks involved. Follow industry news, read up on individual cryptocurrencies, and familiarize yourself with key concepts such as blockchain technology and market volatility. Knowledge is power; staying informed will help you make better decisions in your crypto journey.

In conclusion, getting started with cryptocurrencies involves selecting the right wallet, choosing a reputable exchange, and investing time in research and education. By following these steps, you’ll be well-prepared to dive into the world of digital currencies and explore the potential opportunities that await.

Future of Cryptocurrencies

The future of cryptocurrencies is filled with both excitement and uncertainty. As technology continues to mature and evolve, there are several areas in which cryptocurrencies are expected to have a significant impact.

Mainstream Adoption

One of the critical factors in the future of cryptocurrencies is the rate at which the mainstream population adopts them. As more individuals and businesses begin to accept cryptocurrencies as a form of payment, their value and utility will increase. This widespread adoption could lead to a more significant shift in the global economy, with cryptocurrencies becoming a standard means of exchange alongside traditional currencies.

Institutional Investment

Institutional investors, such as banks, hedge funds, and pension funds, have already begun to invest in cryptocurrencies. As more institutional investors allocate a portion of their portfolios to digital assets, the crypto market is expected to gain further legitimacy and stability. The increased institutional investment could also lead to greater market liquidity and a reduced risk of price manipulation.

Regulation and Compliance

The regulatory landscape will also shape the future of cryptocurrencies. The market could become more standardized and secure as governments and regulatory bodies develop and implement guidelines and rules for using and trading cryptocurrencies. This increased regulatory clarity may also help to alleviate concerns about money laundering, tax evasion, and other illegal activities associated with cryptocurrencies.

Technological Advancements

Cryptocurrencies are constantly evolving as developers create new blockchain protocols and platforms. The development of more advanced and efficient blockchain technologies, such as layer 2 solutions and interoperability between different blockchains, will contribute to the scalability and adoption of cryptocurrencies.

Central Bank Digital Currencies (CBDCs)

Central banks worldwide have started exploring the idea of issuing their own digital currencies. CBDCs could coexist with decentralized cryptocurrencies and potentially promote the adoption of digital currencies in general. However, CBDCs could also pose challenges to existing cryptocurrencies, particularly in terms of competition and regulatory measures.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) is a growing sector that aims to provide financial services using blockchain technology and smart contracts, such as lending, borrowing, and trading. DeFi applications can potentially disrupt traditional financial systems and drive further adoption of cryptocurrencies by providing innovative financial solutions to users worldwide.

Environmental Impact

The environmental impact of cryptocurrencies, particularly those that use energy-intensive mining processes like Bitcoin, has become a topic of increasing concern. The future of cryptocurrencies could see a shift towards more sustainable and eco-friendly consensus mechanisms, such as proof-of-stake (PoS) and other energy-efficient alternatives.

In conclusion, the future of cryptocurrencies is filled with potential and uncertainty. As technology advances and adoption increases, cryptocurrencies could play an even more significant role in the global economy. However, challenges such as regulatory hurdles and environmental concerns must be addressed for cryptocurrencies to reach their full potential.

Earn Money from Cryptocurrencies

There are several ways to earn money from cryptocurrencies, ranging from trading and investing to more passive income methods. Here are some popular methods to profit from the world of digital assets:

Investing

Investing in cryptocurrencies involves purchasing digital assets with a long-term perspective, expecting their value to increase over time. Investors often diversify their portfolios by including a mix of established coins like Bitcoin and Ethereum and promising altcoins. A well-researched and balanced investment strategy can lead to substantial gains over time.

Trading Bots

Trading bots are automated trading software that executes trades based on predefined strategies. They are designed to increase efficiency and minimize human error, allowing you to make more accurate and profitable trades. Trading bots can be customized to your trading style, preferences, and risk tolerance and can be used to trade cryptocurrencies 24/7.

Top 20 Best Crypto Trading Bots (February 2026)

Trading

Trading cryptocurrencies involves buying low and selling high to make a profit. Traders take advantage of market fluctuations and use various strategies, such as day trading, swing trading, and arbitrage, to capitalize on price differences. Trading can be profitable but also carries risks due to the volatile nature of cryptocurrencies. Proper research, risk management, and understanding of technical analysis are essential for successful trading.

Mining

Mining is the process of validating transactions and adding them to the blockchain. Miners are rewarded with newly minted coins for their efforts. Mining can be profitable, but it requires specialized hardware, technical knowledge, and a significant amount of electricity. The profitability of mining depends on factors like the coin’s mining difficulty, electricity costs, and the value of the cryptocurrency being mined.

Staking

Staking is a method of earning passive income by participating in a cryptocurrency’s proof-of-stake (PoS) consensus mechanism. By holding and locking a certain amount of a PoS-based cryptocurrency in a wallet, users can help validate transactions and secure the network. In return, they receive a portion of the block rewards as a form of interest. Staking requires less computational power and energy than mining, making it an attractive option for many crypto enthusiasts.

Airdrops

Airdrops are when new tokens or coins are distributed to existing holders of a specific cryptocurrency or wallet users. Airdrops can occur for various reasons, such as promoting a new project, rewarding loyal users, or increasing token circulation. Users often need to hold a specific cryptocurrency, join a project’s community, or complete specific tasks to participate in airdrops. Airdrops can provide an opportunity to earn free tokens, which may appreciate in value over time.

NFTs and Virtual Real Estate

The rise of non-fungible tokens (NFTs) and virtual real estate has opened up new opportunities to earn money in the crypto space. Users can create, buy, or sell unique digital assets like digital art, music, and virtual land in the metaverse. These assets can appreciate in value, providing potential profits for their owners.

Affiliate Programs

Many cryptocurrency platforms and services offer affiliate programs that allow users to earn commissions by referring new customers. By promoting a platform’s products or services, users can receive some of the revenue generated from the customers they refer.

20 Ways of Making Money with Crypto (February 2026)

Conclusion

FAQs

What is the primary purpose of cryptocurrencies?

The primary purpose of cryptocurrencies is to enable peer-to-peer transactions without the need for intermediaries, such as banks or financial institutions.

How do cryptocurrencies differ from traditional currencies?

Cryptocurrencies are digital, decentralized, and operate on blockchain technology, while traditional currencies are issued and controlled by central banks or governments.

Are cryptocurrencies legal?

The legal status of cryptocurrencies varies by country. Some countries have fully embraced cryptocurrencies, while others have imposed strict regulations or outright bans.

Can cryptocurrencies be used for everyday transactions?

Yes, an increasing number of merchants and businesses are accepting cryptocurrencies as a form of payment. However, the adoption rate varies depending on the cryptocurrency and the region.

Are cryptocurrencies a good investment?

The potential for high returns makes cryptocurrencies an attractive investment for some. However, they also come with high risks due to their price volatility and regulatory uncertainty. It’s essential to conduct thorough research and consider your risk tolerance before investing in cryptocurrencies.